CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81.1% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

What does the VWRL ETF invest in?

The VWRL ETF stands for the FTSE all-world Exchange Traded Fund (*ETF). It is an investment fund that acquires securities with the intention of tracking the performance of the FTSE All-world Index.

*An ETF is an Exchange Traded Fund. They look to track the performance of a basket of assets, commodities or, in this case, an index. An ETF is traded like shares on a stock exchange. It is a pooled investment fund. Trading CFD ETFs through Pepperstone is a derivative of the underlying product.

The Objective

The VWRL fund seeks to provide long-term growth of capital by tracking the performance of the index, a market- capitalization weighted index of common stocks of large to mid-cap companies in developed and emerging countries.

Weighted investments

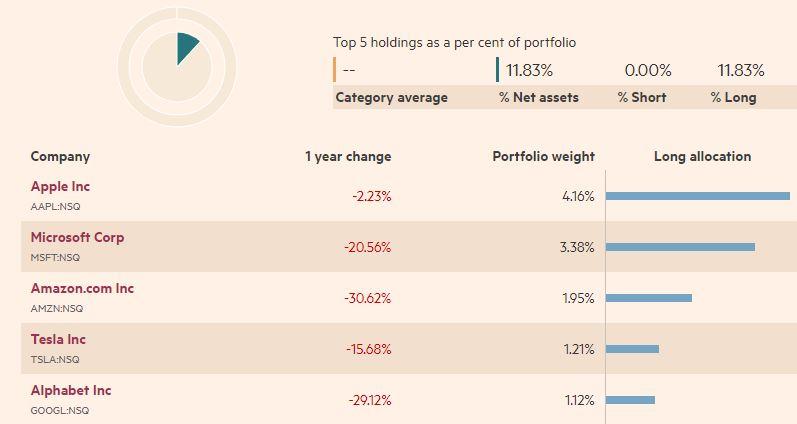

The top 5 holdings within the fund make up 11.83% of overall investments with over a 4% allocation in Apple Inc.

Figure 1 marekts.ft.com 10/10/2022

Invested Sectors

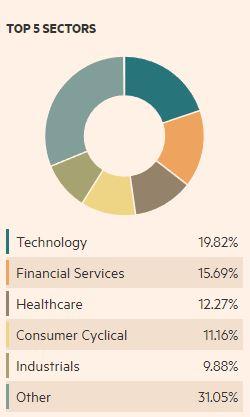

It is plain to see from the single stock allocation that the VWRL is weighted towards the technology sector.

Figure 2 marekts.ft.com 10/10/2022

A look from a technical perspective

Historic price

Since its inception in May 2012, the VWRL ETF witnessed an increase of nearly 200% (from a 31.18 low to a 93.36 high).

Figure 3 TradingView VWRL rally

Although we have seen a correction the downside, we are still holding within a bullish channel formation with trend line support located at 68.50.

Figure 4 TradingView bullish channel

A look from a technical analysis perspective.

VWRL Weekly Chart

The weekly chart offers two possible bullish technical formations for the ETF:

- We look to be holding within an Expanding Wedge formation (dashed black lines). This pattern has an eventual bias to break to the upside.

- The last rally stalled close to the 78.6% Fibonacci level of 90.07 (from 93.36 to 77.90)

Figure 5 TradingView Expanding Wedge and 78.6%

If 77.90 holds (the swing low from the week 13th of June), we could see an extension to the upside to complete a Cypher pattern known as a bearish Butterfly formation.

Figure 6 TradingView possible Butterfly pattern

To learn more about technical analysis, please click here.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.