CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81.1% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The yuan has since fluctuated, experiencing wide daily movement last week amid the mixed headlines of coronavirus impact. People are currently questioning whether the currency will further devalue, or stabilise at the current level?

Is devaluation an option?

As the Chinese government locks down more cities and imposes higher restrictions on residents’ daily travel, factories are expected to experience suspension and shortage of labor and materials, which will, in turn, hit first-quarter exports in China, the world’s largest exporter of intermediate manufactured goods. A weaker currency is an effective way to boost export and GDP, given that consumption and investment are likely to get smashed in Q1.

We probably won’t see another 2015-like depreciation, in which USDCNY rallied almost 2.0% on 11 August 2015 after the PBOC weakened its daily reference price by 1136 points to 6.2298 against the US dollar to tackle the equity market crash and downbeat exports. However, a certain degree of devaluation might be an obvious preventive measure to offset the widely expected severe economic impact, and China has the ability to do so through its daily mid-point price mechanism.

Source: Bloomberg

The PBOC’s massive cash injection and other open market operations to stabilise the economy will continue to weigh on the currency, but we also expect other measures to be announced shortly. Such as reducing the Reserve Ratio Requirement (RRR).

How about stability?

Although the US has just removed China from the ‘currency manipulator’ list early this year, it’s now the Department of Commerce that has the authority to use countervailing duties against undervalued currencies to discourage other nation’s currency intervention. China won’t want to take the risk of getting into a dispute with the US in another trade war.

China, according to the phase one trade deal signed on 15 January, are in the process of opening up its financial service industry to international corporations, removing the equity cap for companies including insurance, securities, fund management, futures and credit rating suppliers, who have strived for years to gain more access to the Chinese market. The more foreign investors buying Chinese assets, the greater the demand for the yuan.

Also, a stable yuan will make it easier for China to meet its purchase target in the 2020 trade deal – an additional $76.7 billion of purchases on top of the 2017 baseline, covering manufactured goods, energy products, service, and agricultural goods. Whether any flexibility will be granted remains in question.

Trump’s choice

The top priority for Trump in 2020 is obviously re-election - he’s a politician. More specifically, he would love to see a continuation of a resilient US economy, the S&P 500 at all-time highs and a narrowing trade deficit. He also knows that a slowing China is a threat to these factors and can definitely play a role in supporting the Chinese economy. Now consider China’s recently announced tariff cut on $75 billion US goods, and will want to see the US respond in kind. We feel Trump has three clear options.

1. Greater flexibility on yuan

This seems unlikely for a few reasons. A weakened yuan would boost China’s exports, as it would give purchasing power to foreign importers. It would also make China’s purchase of agricultural products harder to achieve as the goods now cost more, which is the last thing Trump wants to see ahead of November’s election. A yuan’s devaluation will strengthen the US dollar against other G10 currencies, where a strong dollar, in Trump’s mind, would harm the US economy and widen the trade deficit with China again. That’s why he keeps attacking the Fed over its policy on Twitter.

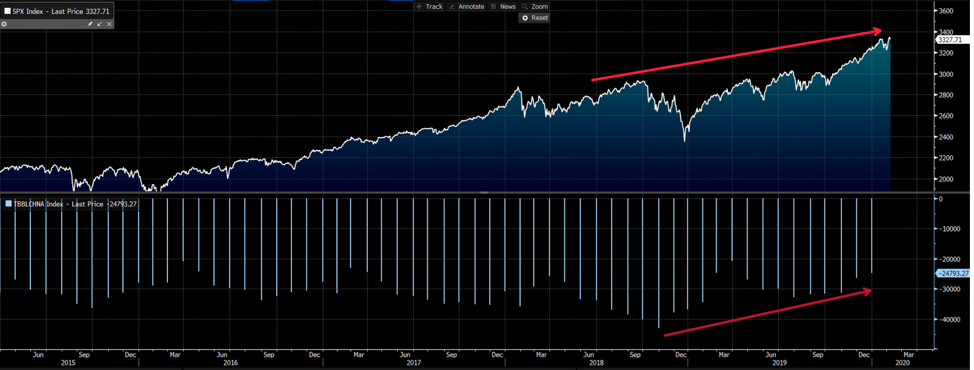

Upper pane: S&P 500 - Lower pane: US trade deficit with China (millions)

Source: Bloomberg

2. Greater flexibility on agriculture purchase targets

This seems more likely than currency flexibility. Relaxation on purchase targets under the trade deal would help China overcome the coronavirus fallout, buying time for China to contain the virus and boosting global confidence. The equity market would continue to rally amid the optimistic sentiment, with the only thing needed to be worried about is the Midwest farmer’s support ahead of the election, as it is unclear how the purchase target would be implemented.

3. Greater flexibility on the current tariff regime

According to the betting markets, Trump is a clear favourite to be re-elected, especially now that he’s survived impeachment and there is fierce competition in the Democratic Primary. Gallup polling shows that President Trump's job approval rating has risen to 49%, the highest since he took office in 2017. Compared to the flexibility on currency or purchase targets, the tariff cut is the most likely and least harmful solution by Trump Administration, showing a friendly gesture in return as well as stabilising the global supply chain.

What’s ahead

It takes time to see how yuan reacts to the spreading coronavirus, and the reaction on the US side is definitely worth monitoring. The world’s two largest economies have the responsibility and wisdom to find a delicate balance amid global uncertainty and panic.

For those who are not able to trade onshore yuan (USDCNY), offshore yuan (USDCNH) is an excellent proxy, which reflects coronavirus’ impact and PBOC’s potential monetary policy action.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.