- Español

- English

- Italiano

- Français

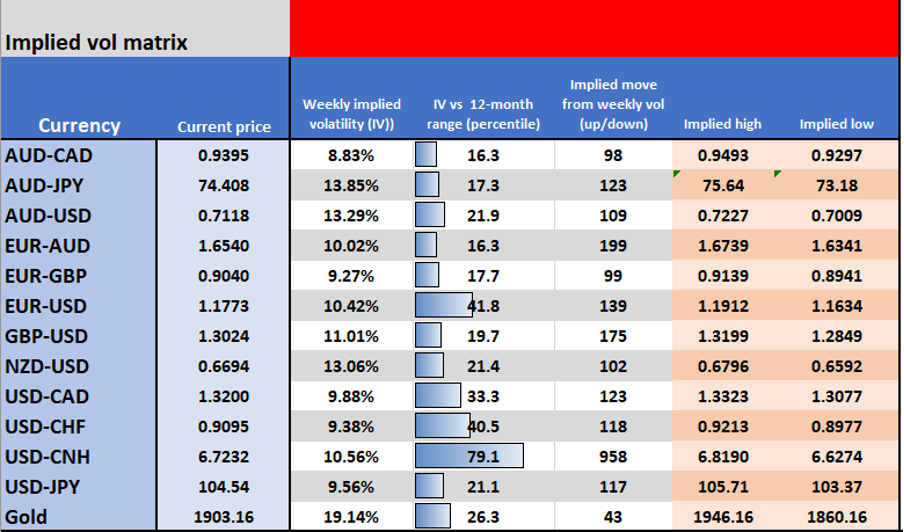

I’ve looked at 1-week implied volatility which expires on 4 November, although there is no certainty we’ll know who the president is on this date and whether one candidate accepts a loss, or it moves to litigation. Perhaps just as importantly we may not know the outcome of the Senate by then either and if the main market thematic is the size and scope of fiscal stimulus in 2021 and the ease by which it passes, then the Senate race is perhaps just as important. 1-week volatility captures the event but not the aftermath.

Looking at EURUSD vols which sit at the 43rd percentile of the 12-month range, one can assume that lockdowns are also a clear issue for markets and reflect in the anticipation of movement in EU assets.

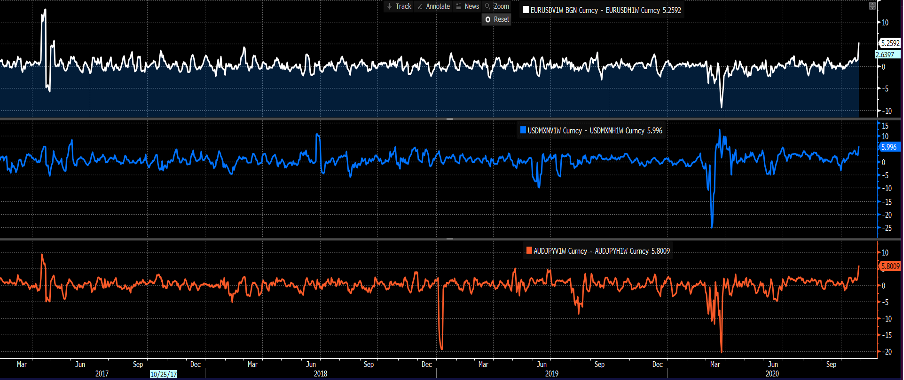

As I showed yesterday, realised volatility is just so incredibly low that this is playing a big part in implied volatility. Traders will not only look at what's to come but will consider the journey it’s been to get here. Here we see implied vols pulling away from realised and holding the biggest differential since 2017.

Select FX 1-week implied – 1-week realised volatility

(Source: Bloomberg)

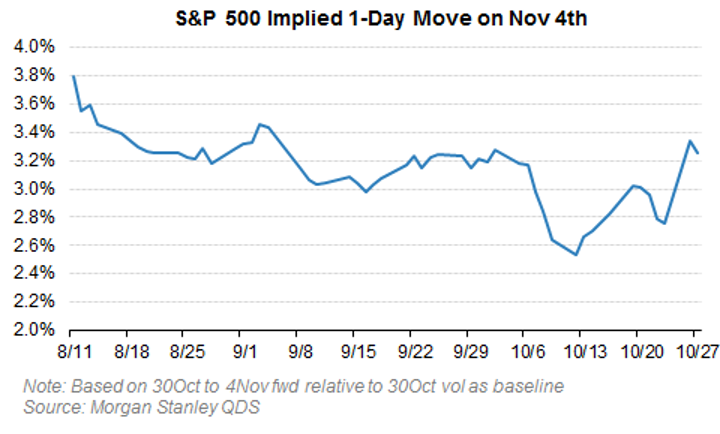

This is the election premium being priced and as the day has gone on the implied move has risen. We’ve seen that in equities for a while with the VIX index elevated but we’re now seeing options traders’ price in movement.

(Source: Morgan Stanley)

For context, we see the implied move (higher or lower) with a 68.2% degree of confidence. For example, the market sees EURUSD moving 139 pips by 4 November and I've put the breakeven levels, or the level where options volatility buyers move in-the-money. If we can understand movement it can be useful for risk management purposes and subsequently position sizing – depending on your timeframe of course.

Related articles

Artículos más leídos

¿Listo para operar?

Empezar es fácil y rápido. Nuestro sencillo proceso de solicitud solo le llevará unos minutos.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.