- Français

- English

- Español

- Italiano

The Presidential debates themselves should give us renewed insight into the candidates ability to ‘be presidential’, views on the economy, the integrity of the election itself, COVID-19, and aspects like race and violence.

We’ve already heard a lot and understand where both parties stand on policy. We can assess polls; political forecasting models and we look at price moves in the market and see that volatility is rising in anticipation of this event.

That said, given a primary job of any trader is to manage risk, it can be advantageous to have a framework around marquee volatility events like a US election. To try and how markets trade into the election as polls change and the probability of each scenario playing out evolves - where the connection between the make-up of Congress, the ability to implement policy and what that means for monetary policy and markets more broadly is key.

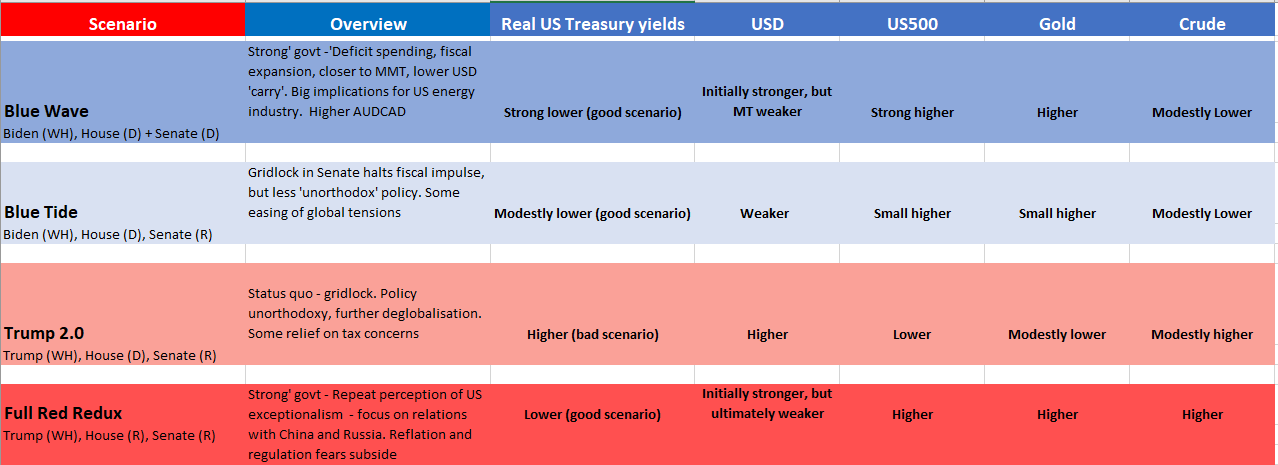

Here is my simplistic playbook on how markets could react given the various scenarios, although, I have left out a Contested election. Naturally, my thesis could prove to be completely incorrect, and many will disagree with the reactions I believe will play out, but it’s about the framework. We will update this periodically, with probability outcomes.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.