- Italiano

- English

- Español

- Français

Friday was about managing risk going into the weekend, but today was different and the move could have legs - where for many playing defence has been the order of the day, while we have also seen traders getting aggressive, with shorting activity in equity picking up, notably in Tesla.

On a cross-asset basis, there has been migration to buy equity volatility (the VIX sits at 19.2%), while there has been a further move into the USD, CHF, and gold, although the flight to quality was not broad-based with US 10-year Treasuries +10bp.

While US bond yields were already moving higher into the US retail sales report (+0.7% vs 0.4% eyed), the stronger outcome of the data set off a further sell-off in US Treasuries, with US 10-year yields pushing into 4.66%. The equity market was initially fine with the rise in yields, but as headlines rolled in that Israel had vowed a new response the sellers gained full control – it was when S&P500 futures traded through Friday’s low (5150) and then the 50-day MA (5142) that the floors lit up with more indiscriminate selling in equity.

The moves were then compounded by a rush to hedge risk, with funds buying volatility, where noticeable we saw the VIX index trade through 18% and into 19.46%. On the day 1.31m VIX call options traded vs 573k puts, so traders have been positioning for higher volatility and hedging portfolios accordingly. It’s no surprise that we’ve seen a sizeable 149k VIX futures traded, again well above average – higher market volatility leads to a whole range of selling activity from systematic players, and pension funds who target levels of volatility to determine their equity allocation. In these uncertain times high volatility begets higher volatility.

We’ve been left with the S&P500 tracking its highest high-low trading range since March 2023 (119 points), with price closing near the lows of the day. Plenty for the day traders to work with, and this sort of price action, with the various indices seeing a strong high-to-low trend day, will not have gone unnoticed, and to many, these are ideal trading conditions.

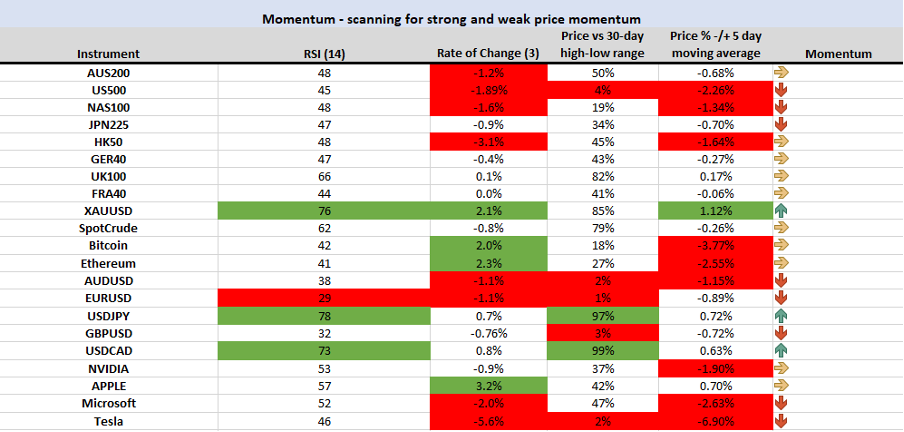

Momentum monitor – markets on the move

We see higher FX volatility playing through, with the USD ripping vs all currencies. There has been a solid unwind of carry positions, with the higher-yielding plays – BRL, COP, CLP, and ZAR – all seeing big percentage changes. The USD is king, and while overbought it is not at a stage where mean reversion players are just yet seeing a higher probability of a snapback. There are too many tailwinds for the greenback right now – haven appeal, momentum, relative interest rate settings and relative economic data trends. Pullbacks, it seems, will be shallow and well-supported.

Gold has been the classic geopolitical hedge, although we could have seen an even more pronounced move and a possible upside break of $2400 if crude (+0.2%) had participated. The fact that XAUUSD rallied 1.7% despite the move in the USD, and the 5bp rise in US 10YR real rates cements gold as perhaps the primary portfolio hedge given unfolding news flow. Conversely, there is a risk that gold could find a solid sell-down should Israel refrain from escalating, but for many the headlines suggest an increase in conflict is more likely than not and gold can offer defense in the portfolio.

Asia faces another tough day at the office, with the JPN225 called -1.4%, HK50 cash -1.2% and the ASX200 -0.7%. There is certainly not much in the news flow to inspire risk-taking and there is a growing list of factors to refrain from buying and to manage exposures, which of course, can see the buy side of the order book dry up, which means we get more exaggerated price moves.

China gets focus, not just because it performed admirably yesterday and we watch to see if the index can outperform, but also, we get Q1 GDP (consensus +4.8%), industrial production, retail sales and fixed asset investment.