I CFD sono strumenti complessi e comportano un alto rischio di perdere denaro rapidamente a causa della leva finanziaria. Il 75.1% dei conti degli investitori al dettaglio perdono denaro quando scambiano CFD con questo fornitore. Dovresti considerare se hai capito come funzionano i CFD e se puoi permetterti di correre l'alto rischio di perdere il tuo denaro.

- Italiano

- English

- Español

- Français

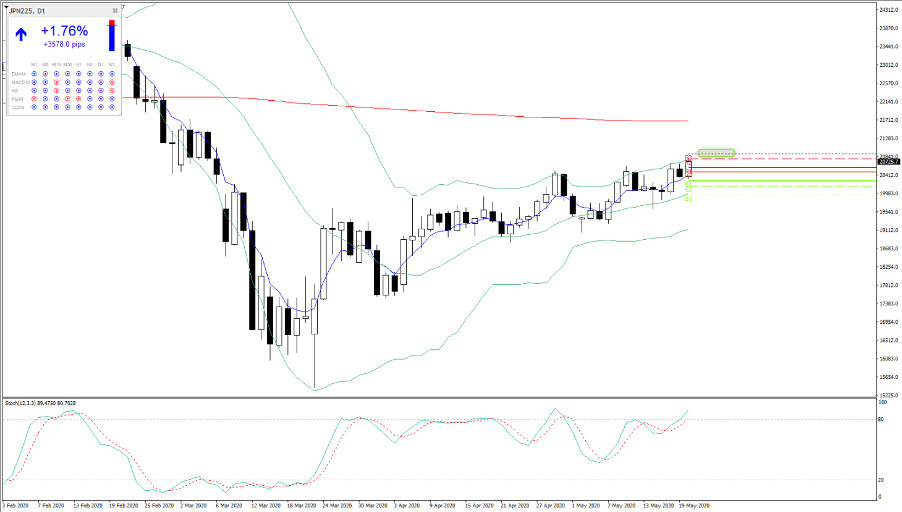

Its break-out city in Asian equities, notably for ASX200 and Japan, and the pain trade remains to the upside – the question is whether to buy the open or wait to see how price reacts, in this newfound territory.

Japan especially looks interesting, with the 200-day MA the clear target, although on the day, we see R3 (pivot) into 20,908, which marries nicely with a move above the top Bollinger Band, and that would be area to fade and look at mean reversion short positions.

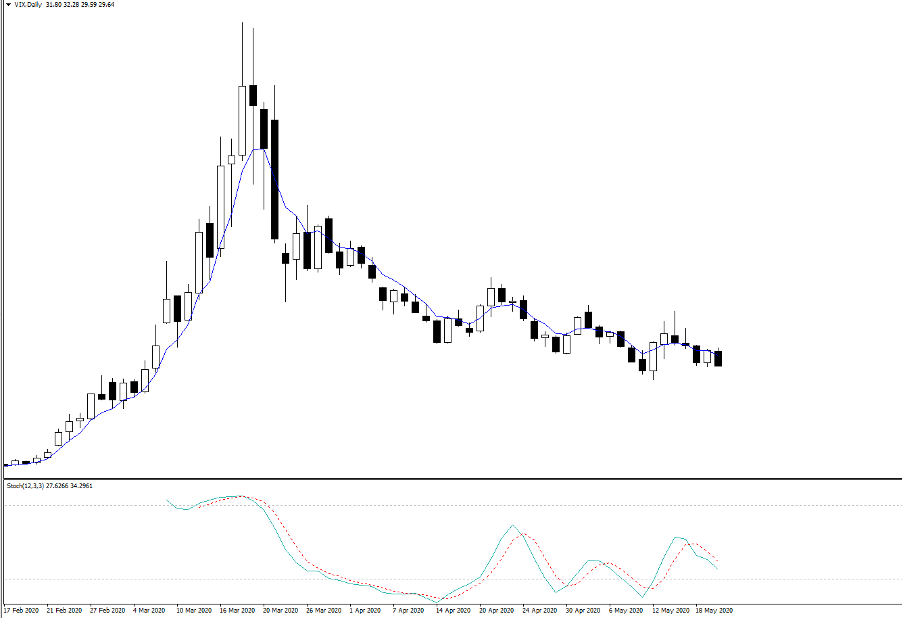

There hasn’t been a huge amount of news to drive but we’ve seen some selling of volatility across the boards, with the VIX back below 30% and at 27.99% in the VIX cash the vol index implies that the S&P500 should trade (up or down) by 1.8% each day.

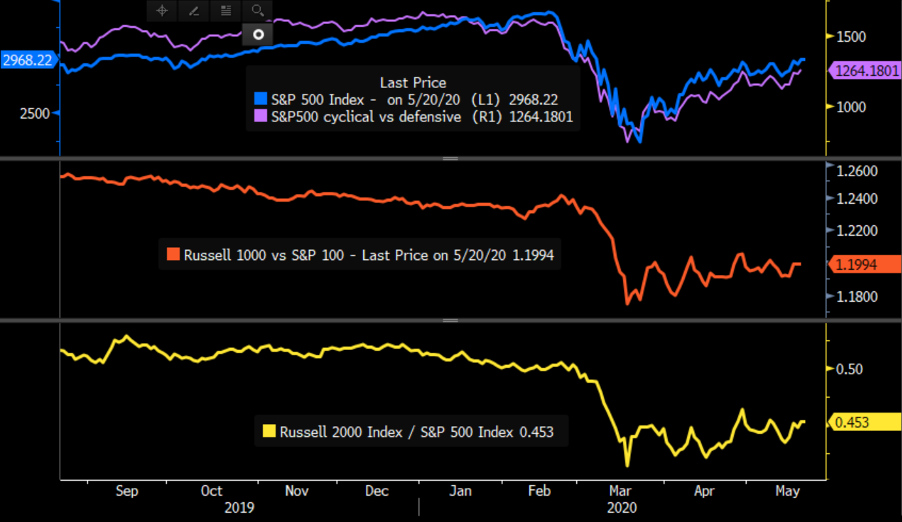

The sheer fact the VIX index (the 30-day implied volatility in the S&P500) is even at these levels despite such strong moves in the S&P500 is impressive. Especially, when we’ve seen good outperformance of cyclicals vs defensives sectors, with small caps starting to look like they are working better than large caps which is a sign of better economics ahead - as is crude.

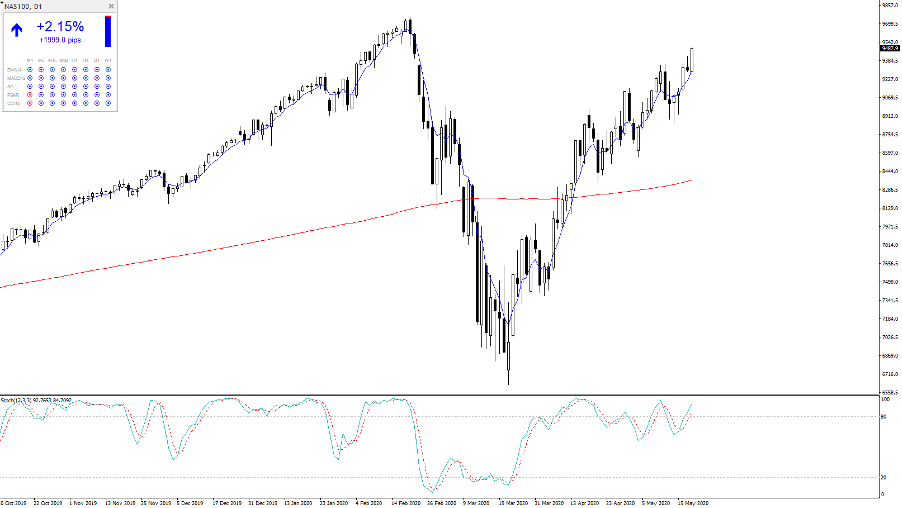

That said, recently when we see these breakouts it’s when that equities turn, and for those who follow Demark, we saw a 13 sequential count on both the S&P500 and Nasdaq 100 (cash and futures), which can indicate a possible reversal of the trend.

Still, on current price action, the set-up on the daily looks good for the S&P500, and even more so in the NASDAQ 100, where the tech index is a whisker away from a new ATH. Incredible stuff and we are about to see the S&P500 test the 200-day MA, which when we consider it was 27% below the average on 23 March is mean reversion at its most intense. Could the 200-day MA act as resistance? The ASX 200 has 12% to go.

As we see, we can see the NAS100 now 13.6% above its own 200-day, with the market eyeing a new ATH.

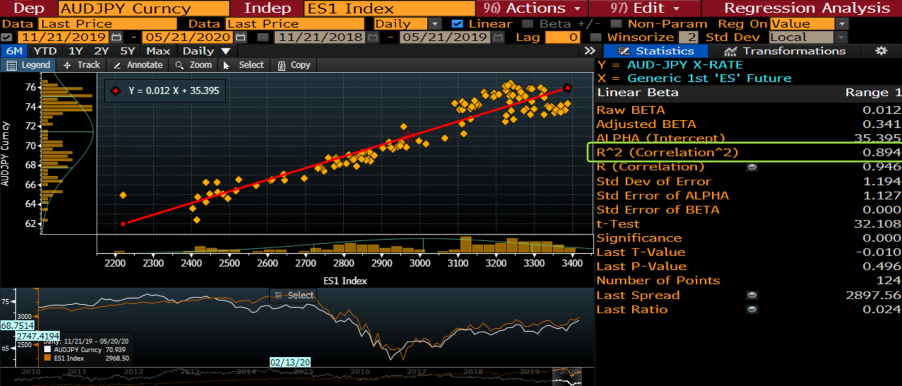

For FX traders’ equities, rates and volatility matters. When the US500 is firing and volatility is pushing lower, we see risk FX working. To provide a statistical understanding, the six-month correlation coefficient between the S&P500 futures and AUDJPY sits at 0.894 – for understanding, 89.4% of the variance in the AUDJPY can be explained by the S&P500 futures. It is not random in any way. So, tell me where the S&P500 is going to go, and I will tell you where risk FX is headed.

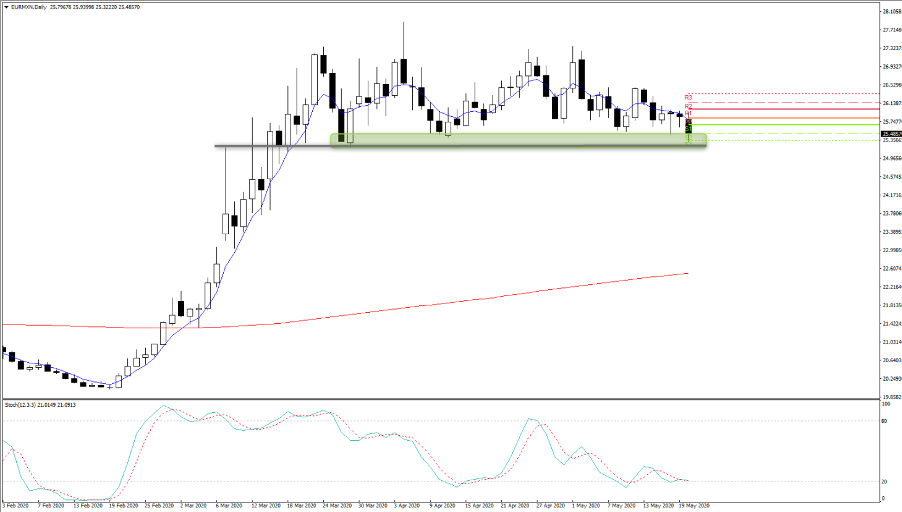

There is little fundamental reason why the ZAR has rallied 2.1% against the JPY, or why MXNJPY has pushed up 1.7% except for pure sentiment. EURMXN has come up on the radar, with carry buyers finding the low FX vol, limited moves in US Treasuries and positive moves in equities working.

GBPMXN is already there and moving lower in the channel – personally, I would hold off from shorts in this cross, with a preference to reload at higher levels as conditions are ST oversold but you can see the trend is progressing nicely.

Related articles

Iniziamo a fare trading?

Iniziare è facile e veloce. Con la nostra semplice procedura di apertura conto, bastano pochi minuti.

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e quindi esso non dovrebbe essere considerato come tale. Le informazioni qui fornite, da parte di terzi o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto o strumento finanziario o la raccomandazione di partecipare a una particolare strategia di trading. Consigliamo a tutti i lettori di questi contenuti di informarsi in maniera indipendente. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.