- Italiano

- English

- Español

- Français

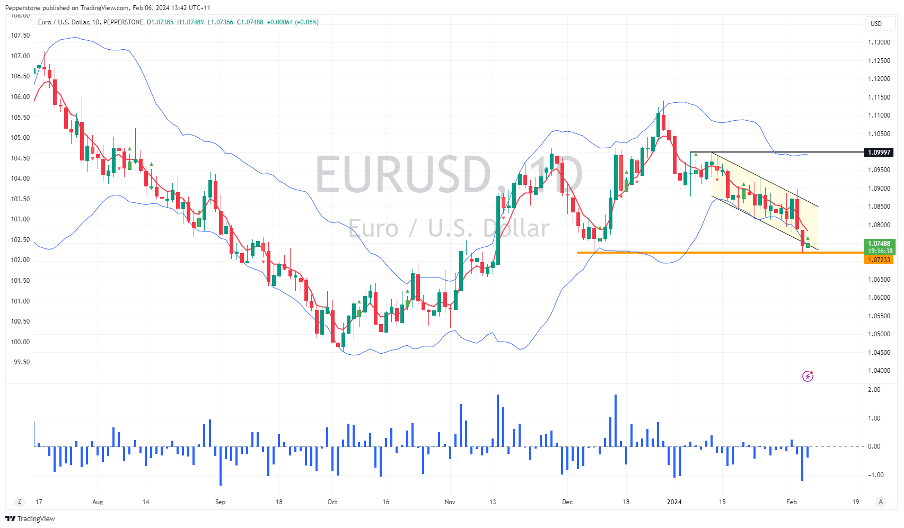

EURUSD – ‘hold the line’

As US economic data continues to come in above expectations and Fed chatter pushes back on imminent rate hikes, we see the yield premium that US Treasury’s hold over German debt blowing out. For example, the yield premium to hold US2yr Treasuries over 2yr German bonds has pushed to 185bp (or 1.85%), having been at 154bp in mid-Jan. This is putting a bid into the USD, with the exchange rate pushing into the December pivot low of 1.0723 and breaking the recent channel lows. By way of momentum, we see that the 2-day ROC has moved sharply lower to -1.20 – consider that since Jan 2023 on the 14 occurrences where the 2-day ROC has pushed below -1, 80% of the occurrences have resulted in a mild short covering rally the following day. The trend, however, suggests this pair trades lower but I would look to initiate new shorts either on a close below 1.0723 or limits into 1.0775.

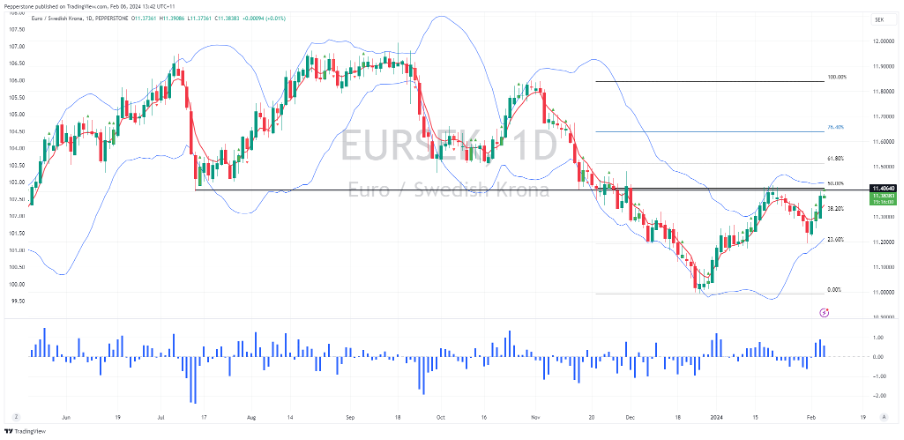

EURSEK – SEK most sensitive to a lift in interest rates

USDSEK has completed an inverse head and shoulders, and the probability is this pair moves higher over time. The SEK is one of the most sensitive to higher bond yields and the repricing of interest rates, so given the backdrop we’re seeing unfolding in global bond markets we could easily see a further underperformance in the SEK. Given the USD pairs are really all moving together (just with different betas), I am keen to look at the cross rates and look at opportunities ex-USD. EURSEK has a similar thematic but the impact of higher bond yields, and the prospect that the Riksbank will be more dovish than the ECB is seeing EURSEK push into the Jan highs and 50% retracement of the Oct-Jan sell-off. It feels like there could be good supply into 11.4244, but an upside closing break here would be a signal for new longs.

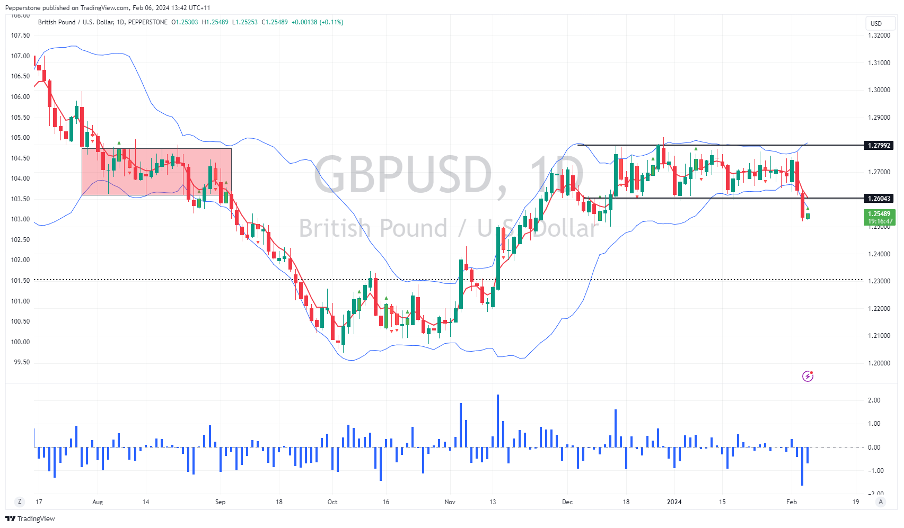

GBPUSD – a retest of 1.2600 looks likely

The downside break of the 1.2800 to 1.2600 range the pair has held since 14 Dec has been well traded by clients. Looking at the current skew in open interest, traders see a higher risk of a move back to the breakout point, with 71% of open positions currently held long. I see the risk of modest short covering through late Asia but would take the timeframe in and see how the price reacts into the former range lows and 5-day EMA. A rejection and increased signs of a trend day would suggest reengaging with shorts for a move towards the 100-day MA at 1.2469. Staying on the GBP theme, GBPCHF is also on the radar with a tactical view of potential upside - given the set-up on the higher timeframes its aggressive to be long the cross at levels, but if that is the case, I would be placing tight stops below 1.0880, with a view to add to the position on a close through 1.0960.

China CN50 index – putting in a base?

The CN50 represents the largest 50 mainland A-share companies but trade (as a futures product) on the Singapore futures exchange.

These are interesting and mysterious times in China’s capital markets, but one thing is clear, most want to be involved in picking the turn in these markets. While there are many equity indices to choose from - covering tech, large and small caps, as well as regionally specific, it’s the CN50 index which looks most likely to be putting in a base, with the potential to turn higher. Here, a push through the double bottom neckline at 11,378 could indicate a higher confidence that the lows have been seen and a further push to 12k could be on the cards. Conversely, a downside break of 10,800 could see the bear trend gain renewed legs.

Tactically I like long CN50 / short US2000 trade – the trade is working, and both legs are priced in USD.

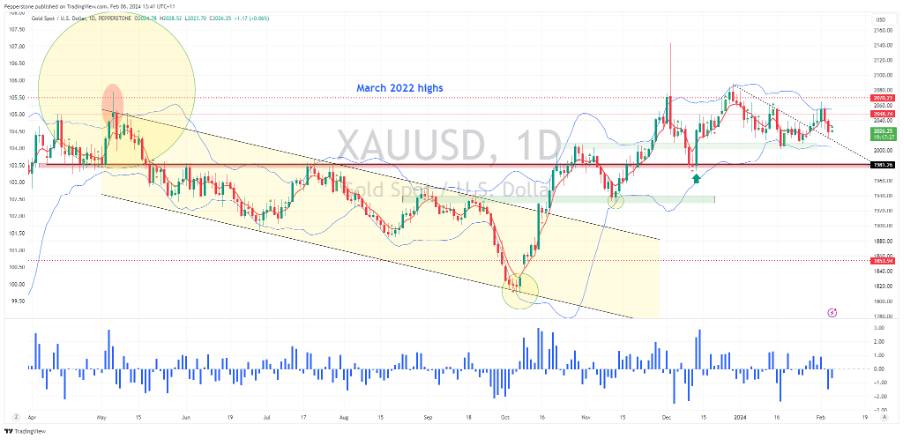

XAUUSD – holding in well despite moves in rates and the USD

With US 10-year real rates pushing higher into 1.90% and rate cut expectations being priced out of the US interest rate and swap curve, and with the USD breaking out, gold longs should be enthused by the yellow metals inability to roll over and head into $2000. The ability to absorb several traditional negative catalysts suggests there are big counterweights in place, such as foreign central bank buying – but as we see on the daily gold is tracking a sideways range with volatility compression a core theme. The longer we see the volatility squeeze, the more powerful the potential trend could be. For now, playing a range of $2060 to $2005 seems the play.