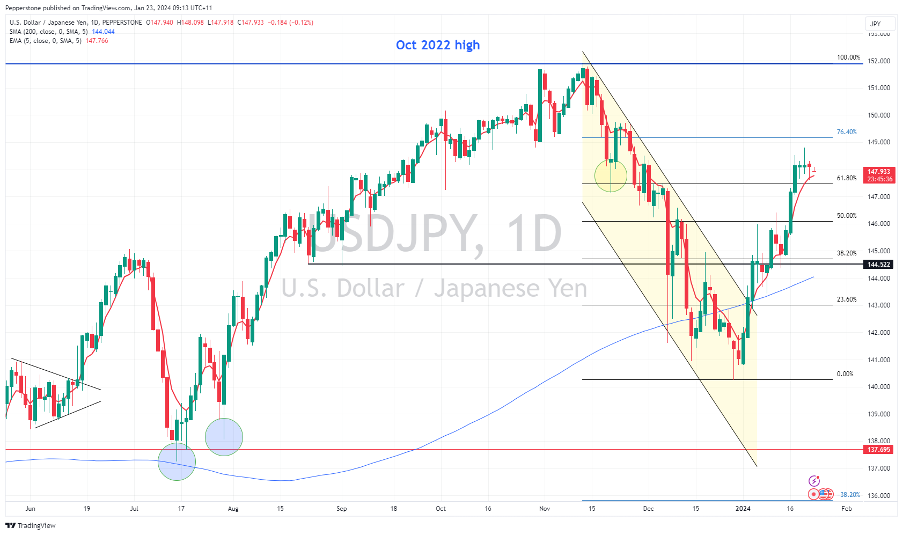

USDJPY – consolidation before a new leg higher?

After a rally from 140.25 to 148.80 in recent weeks we see price consolidating, with the past 3 bars showing exhaustion in the buying. A clear catalyst has been the US 2-year Treasury rising from 4.11% to 4.39%, where we also see the implied probability of a 25bp cut at the March FOMC meeting falling from 90% (in late Dec) to currently stand at 41%. USDJPY is always the purest rates play in G10 FX markets, so to promote a move through 148.50, we’ll likely need to see the US data flow coming in above consensus, driving expectations of a cut in March further lower. US core PCE inflation (due on Friday) would be the key catalyst here, while today's BoJ meeting is considered by many to be a non-event for markets, if the BoJ refrain from providing any signal on policy then it could spur further selling of JPY. Subsequently, while USD positioning is becoming stretched, I favour this pair higher, where a push through 148.50 should see 150.00/50 come into play.

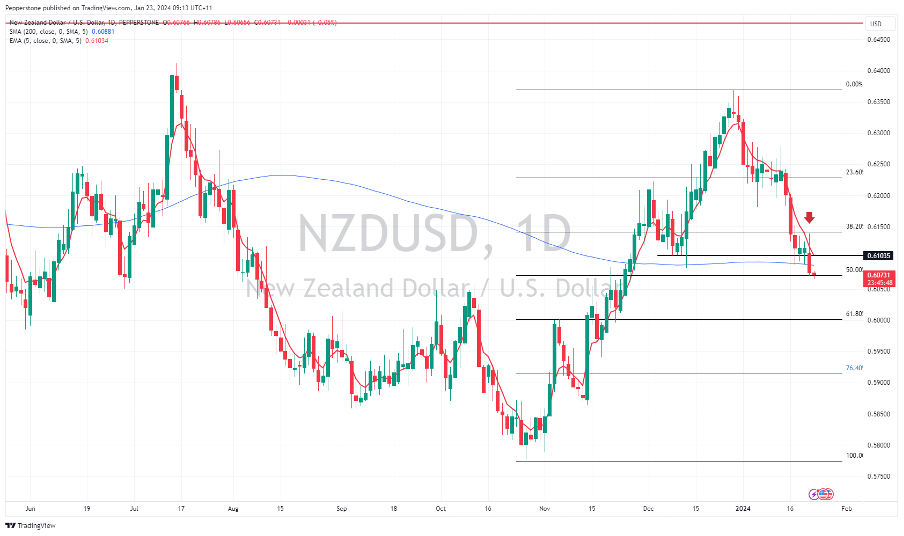

NZDUSD – the flightless bird

The NZD has emerged as the weakest currency in G10 FX of late, and this can partly be explained by negative sentiment towards China, but also recent NZ data flow has underwhelmed. Tomorrow, we see NZ Q4 CPI with expectations of 0.5% QoQ / 4.7% YoY (from 5.6%), where a downside surprise would likely bring forward expectations of the first 25bp rate cut from May to the April RBNZ meeting. NZDUSD is printing a bearish outside day reversal and taking out the lows of the prior 2 inside bars. We also see a close below the 200-day MA which acted as support of late. So, the path of least resistance is lower and 0.6000 may be tested shortly. I also like AUDNZD upside on growing central bank policy divergence.

HK50 – October lows in sight

With the various HK/China equity indices a whisker away from the October lows, we see the drawdown from the January peak amounting to 34%. It feels like foreign investors have simply given up and capitulated, with the Hang Seng Property Index closing -4.6% yesterday. International money managers have seen drip feed fiscal and monetary stimulus measures, and these measures are not compelling a market still seeing too much risk, while they can look to the US and see equity performing well here. That said, headlines that China’s Premier Li Qianq has called for new measures to support the stock market are worth exploring – the market wants to see bold action, and anything less could give traders new levels to initiate shorts into.

Bitcoin – break it down

With the BTC spot ETF now behind us and the flows into these ETFs perhaps underwhelming some of the more bullish contingents in the markets - we see price breaking the October uptrend, as well as the range lows around 40,200. Near-term, I favour taking a momentum approach and playing this from the short side, with the former consolidation highs at 37,900 as a near-term target.

Tesla – can earnings halt the bear trend?

Tesla reports quarterly earnings tomorrow, with the market eyeing delivery number guidance (notably in the wake of a series of price cuts) and any narrative that suggests the world is not as oversupplied (in EVs) as what has been speculated on of late. As we see on the daily chart the trend is firmly lower and mature, where rallies are being consistently sold into, with the 5-day EMA defining the trend. The options market prices a 5.4% move (higher or lower) on the day of reporting, and with short interest building in this name there is a chance of an outsized move on the day of reporting.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。

.jpg?height=420)