What is the definition of the All Ords?

All Ords is an abbreviation for All Ordinaries, the oldest index in Australia. The short code is XAO. Covering 480 of the largest Australian Securities Exchange (ASX), all Ords is considered a great barometer for the Australian Stock Market.

The largest company by market cap is The Commonwealth Bank and holds a weight of 6.74% of the XAO index.

The financial sector is by far the largest, weighing in at 26.99% of the XAO.

Figure 1 stockmetric.net market cap

The All Ords was set in 1980 with a starting level of 500. In its 42-year lifespan it reached the dizzy heights of 7956 in January 2022. That is an incredible 1491% increase from the launch.

Figure 2 Trading View XAO 1491% increase

Heavily weighted in Banks

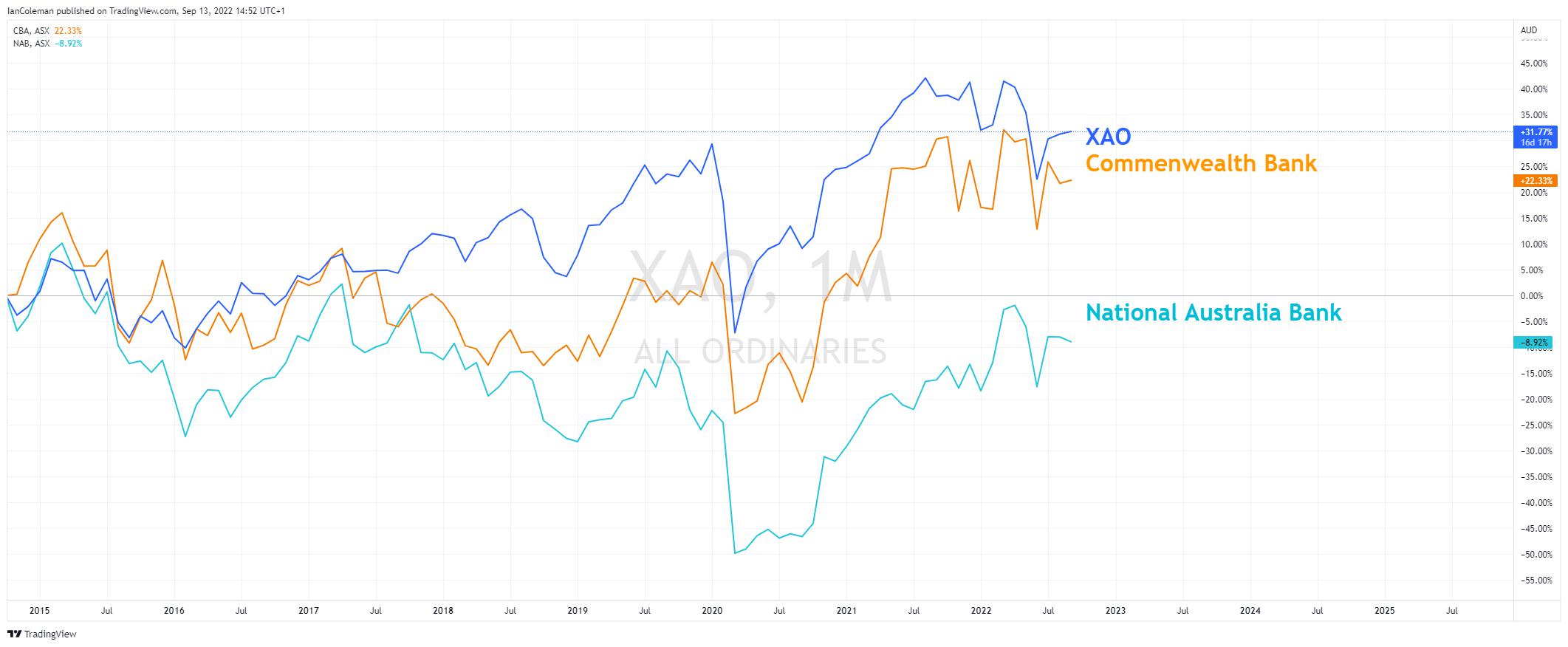

We have already mentioned that the All Ords is heavily weighted towards banks and the financial sector. This becomes clearer when we look at an overlay chart highlighting the sustained rally from the 2020 lows.

Figure 3 Trading View XAO overlay financial sector

A breakdown of the performance from a technical perspective

A look at the weekly chart and we can note an Expanding Wedge pattern that has a bias to break to the upside. We must express a word of caution here. The measured move target for a wedge breakout is the start of the wedge.

In this scenario, that would take the All Ords mildly higher through the break line to a target level of 7956, possibly forming a double top.

We can also clearly see that levels close to the 7900 Big Figures continue to attract sellers in August 2021, and January and April of 2022.

Figure 4 Trading View Weekly Expanding Wedge

Breaking down to the daily chart and as long as the 7386 swing high from the 16th August holds back the bulls, then a more potentially rewarding support zone would be 6678-6666. This would then form a bullish cypher pattern knows as a Bat formation.

Figure 5 Trading View XAO potential BAT support

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。