差價合約(CFD)是複雜的工具,由於槓桿作用,存在快速虧損的高風險。81.1% 的散戶投資者在與該提供商進行差價合約交易時賬戶虧損。 您應該考慮自己是否了解差價合約的原理,以及是否有承受資金損失的高風險的能力。

- 繁体中文

- 简体中文

- English

- Español

- Tiếng Việt

- Português

- لغة عربية

- ไทย

A Playbook for The Last ECB Decision of 2022

This week, markets could go anywhere…we react with stealth, and we simply must be in front of the screens to do so. The US CPI print sets the tone above all else – on an in-line (with consensus) print the market will do what the market wants to do, but it’s the outlier outcomes/extreme on the distribution of expectations, where we could see lasting moves in price that are easier to trade. Core CPI surprises with a 5-handle for example – unlikely, but it would cause the NAS100 and risk FX to go for it into year-end. Conversely, a hotter CPI – say 6.4% (and above) and a hawkish set of dots from the Fed and statement from Powell could see funds call it a day for 2022 – risk bleeds into 2023 and funds buy back USD shorts.

Going into the data we see the aggregation of flow - The set-up in US500 looks ominous but with OPEX this week again it's hard to make a call – we trade price and if it breaks lower there’s a trade there – EURUSD finds supply into 1.0600, so look for a 1.0600 to 1.0400 range – although the options breakeven implied move on the week suggests 1.0700 to 1.0350 with a 68.2% level of confidence. AUDUSD looks poised for a move higher, with 0.6850 a big level to watch, but if the CPI print is hot then the AUD will underperform in G10 FX. GBPUSD trades a wedge into horizontal resistance, so the bulls need a firm close through 1.2300 to negate that, while a downside close below 1.2130 would accelerate the falls. XAUUSD has been well traded by clients, but I think $1760 is the level to watch this week and think it gets there.

It’s a huge week – know what’s on the calendar. Size your trades and know your risk – 2023 is in our sights.

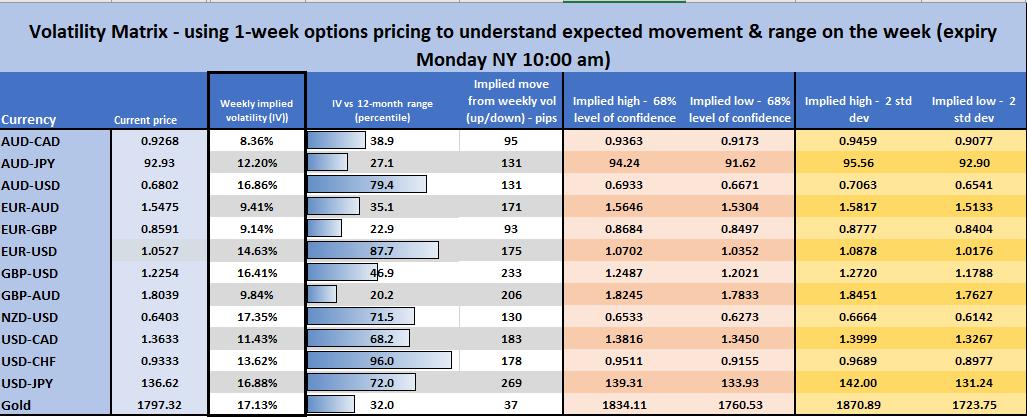

The implied volatility matrix – we see the weekly implied vol level and then calculate the expected move through to Monday (with 1 and 2 standard deviation) – this helps know the markets-based anticipation of movement.

What’s on the radar this week?

US

Triple witching – a market event to consider, where we get the expiry of SPY ETF, S&P500 index and futures options expiry – some $2.5t of notional expire, so this could have big implications for the equity market as options dealers manage their exposures accordingly.

US CPI (Wed 00:30 AEDT / Tue 13:30 GMT) – One could argue that the US CPI print is the big volatility event of the week given the market is desperate to see inflation falling towards target – Subsequently, the market won’t take too kindly to any print that doesn’t show inflation heading lower and subsequently has them questioning a strong consensus view for 2023. The economist's consensus is for headline CPI to fall to 7.3% YoY (from 7.7%) and core to drop to 6.1% (from 6.3%). So, should we see US core CPI above 6.3% then the USD should rally hard, and equity should find decent sellers. Conversely, a read below 6% would be a surprise and the USD bears should find comfort in that.

Where do the risks reside? It's hard to make a clear playbook on price if the numbers come in line with expectations, but I expect big moves in rates, the USD, and equity if we see an outlier print and moves that could potentially trend into year-end. Do consider the CPI ‘fixings’ market is pricing headline CPI at 7.2% YoY. The Cleveland Fed CPI nowcast CPI model – which has found form in prior CPI reads - suggests upside risk vs consensus expectations, with the model running at 7.5% YoY for headline and 6.3% core respectively – an outcome that could lift rates pricing and the USD.

FOMC meeting (Thurs 06:00 AEDT / 19:00 GMT) and chair Jay Powell press conference (06:30 AEDT) – It would be a big surprise if we didn’t see the Fed step down to a 50bp hike – the economic projections should show 2023 core PCE inflation revised down to 2.9% (from 3.1%), with a 20bp cut to the 2023 GDP forecast to 1%. One focal point and where the algo’s could react is whether the fed funds projection (or ‘dot’) for 2023 is lifted from 4.6% to 4.9% or 5.1% - The market is pricing the fed funds terminal rate around 5%, so we are talking semantics here – but a lift to 5.1% is my own base case and could be a quasi-statement of intent – but could we see the median estimate even higher? We also want to understand if Jay Powell opens the door to a slowdown to a 25bp hiking pace from February - again, while in line with market pricing, this could be taken that we’re closer to the end of the hiking cycle and is a modest USD negative.

Looking ahead, with the rates market pricing 133bp of cuts through Dec 2023 to Dec 2024, one suspects there are modestly hawkish risks when trading the FOMC meeting and therefore upside risks to the USD - especially with Jay Powell’s press conference like to continue beating the drum that the risks of overtightening are a lesser evil than under-tightening.

Retail sales (Fri 00:30 AEDT /13:30 GMT) – clearly overshadowed by the prior day’s events, it’s worth pointing out that the market eyes a fall of 0.2% MoM, with the retail ‘control’ group element, eyed at -0.1%. With the market seeing low growth/possible recession as one of the core themes to run with for 2023, this consumer data could get greater attention than usual.

Fed speakers – we get San Francisco Fed president Mary Daly speaking on 17 Dec (04:00 AEDT / 17:00 GMT) – Daly is the first to speak after Powell’s testimony - she may clear up any unwanted market reaction.

Europe

ECB meeting (Friday 00:15 AEDT / 13:15 GMT) – the market prices 53bp of hikes, so we shouldn’t see too great a reaction when the ECB hike the deposit rate by 50bp to 2%. To many at the ECB, the current policy setting is already in the vicinity of neutral, so it's easier to justify a step down to 50bp as we head into restrictive. Still, with inflation estimates likely to be revised up this is not the time to be letting financial conditions ease too intently. We see markets pricing a terminal rate of 2.8% by mid-2023, so the market expects another 80-odd basis points of tightening through next year. Also, Quantitative Tightening (QT) is a big factor here, with the market expecting increased colour AND A loose commitment on the start date and the pace at which the bank reduces its bond holdings – potentially one where we’ll get real context in Q123. Watch the 10YR Italian BTP - German bund yield spread as a key driver of EURUSD – at 1.90%, if this widens above 2% then EURUSD should fall.

UK

Nov CPI (Wed 18:00 AEDT / 07:00 GMT) – the market eyes headline UK CPI at 10.9% (from 11.1%) and core unchanged at 6.5% - naturally the GBP will be driven on a sizeable miss/beat, where this could influence UK terminal rates pricing, with the market currently pricing the UK bank rate at 4.55% by June 2023.

BoE meeting (Thurs 23:00 AEDT / Wed 12:00 GMT) – The BoE is expected to hike by 50bp to 3.5%, although there is a 20% chance of a 75bp hike. There will be some focus on the level of dissent against a 50bp hike within the bank, and how the statement marries to the terminal pricing of 4.55% - with rates traders expecting a further 100bp of hikes through the first half of 2023. There seems no clear one-sided risk for GBP from the meeting, but the set-up in GBPUSD is interesting, with clear resistance into 1.2300 and a rising wedge – GBPCAD longs continue to be the momentum/trend play.

Australia

RBA gov Lowe speaks (Wed 09:30 AEDT / Tue 22:30 GMT) – Dr Lowe is likely to guide to maximum flexibility, being non-committal on future policy direction. There is a lot of water to flow under the bridge ahead of the 2 February RBA meeting, where I expect a 25bp hike, and aside from changes in broad financial conditions, actions from the Fed and the Chinese govt – which could influence - we have 2 Aussie jobs reports and the Q4 CPI print (25 Jan). Hard to see this speech moving the AUD too intently, although we see AUDUSD 1-week implied vol at elevated levels, so traders are expecting movement in this pair this week.

Aussie employmentdata (Thurs 11:30 AEDT / Wed 23:30 GMT) – the market expects 17k net jobs to have been created, with the U/E rate expected to remain at 3.4% - the participation rate will play a role there, with the consensus expecting this to come in at 66.6%. While we assess if the RBA has another hike left in the tank on 2 Feb, I'm not expecting the jobs report to be a huge vol event.

China

Aside from further re-opening news flow, we get Nov credit data (no set time - new yuan loans are eyed at CNY1.4t). We also get industrial production (consensus 3.7%), retail sales (-3.9%) and fixed asset investment (5.6%). Not expecting the Chinese data flow to move markets too intently, as we are looking at the future and life where citizens have increased freedoms and economics respond as such. Long HK50 / short NAS100 (or US500) continues to work well as a long/short strategy.

Switzerland

SNB policy rate (Thur 19:30 AEDT / 08:30 GMT) – The market expects a 50bp hike to 1% - a lot to like about the CHF in 2023 and while Swiss rates have been rising, if global growth is going to be a major concern for 2023, then the CHF typically outperforms in this environment. USDCHF is breaking down, but we see divergence between the price and the RSI. Tactically I feel there are modest upside risks to the USD this week but the set-up in USDCHF does look heavy. EURCHF is one for the radar, with the 4-hr chart starting to break down – I like this lower for 0.9780.

Charts

GBPUSD daily

US500 daily