Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English

- 中文版

What is the definition of the All Ords?

All Ords is an abbreviation for All Ordinaries, the oldest index in Australia. The short code is XAO. Covering 480 of the largest Australian Securities Exchange (ASX), all Ords is considered a great barometer for the Australian Stock Market.

The largest company by market cap is The Commonwealth Bank and holds a weight of 6.74% of the XAO index.

The financial sector is by far the largest, weighing in at 26.99% of the XAO.

Figure 1 stockmetric.net market cap

The All Ords was set in 1980 with a starting level of 500. In its 42-year lifespan it reached the dizzy heights of 7956 in January 2022. That is an incredible 1491% increase from the launch.

Figure 2 Trading View XAO 1491% increase

Heavily weighted in Banks

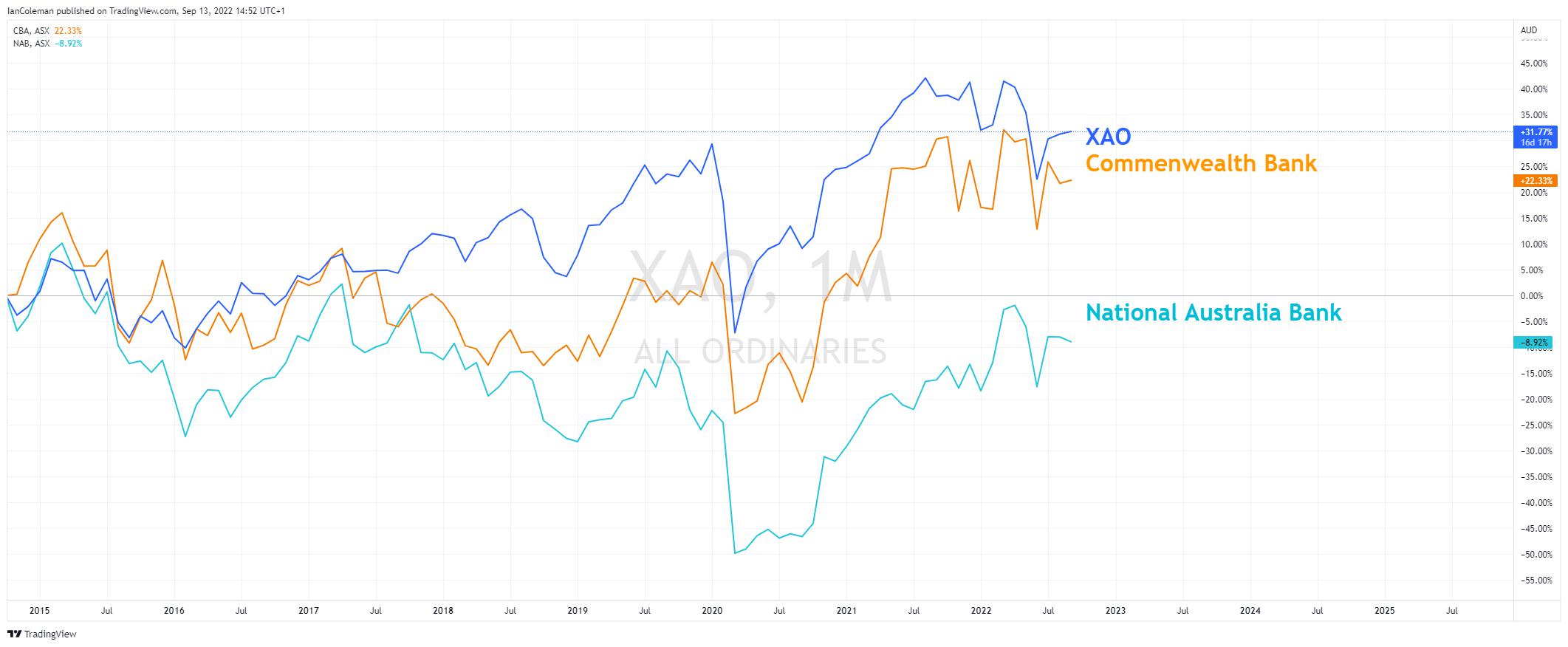

We have already mentioned that the All Ords is heavily weighted towards banks and the financial sector. This becomes clearer when we look at an overlay chart highlighting the sustained rally from the 2020 lows.

Figure 3 Trading View XAO overlay financial sector

A breakdown of the performance from a technical perspective

A look at the weekly chart and we can note an Expanding Wedge pattern that has a bias to break to the upside. We must express a word of caution here. The measured move target for a wedge breakout is the start of the wedge.

In this scenario, that would take the All Ords mildly higher through the break line to a target level of 7956, possibly forming a double top.

We can also clearly see that levels close to the 7900 Big Figures continue to attract sellers in August 2021, and January and April of 2022.

Figure 4 Trading View Weekly Expanding Wedge

Breaking down to the daily chart and as long as the 7386 swing high from the 16th August holds back the bulls, then a more potentially rewarding support zone would be 6678-6666. This would then form a bullish cypher pattern knows as a Bat formation.

Figure 5 Trading View XAO potential BAT support

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted..