CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.1% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

– short sellers, it seems, have gone to town, and as any equity trader will attest to - when you know there is a wall of sellers out there you stand aside and you wait for consolidation and better levels to emerge.

(KRE ETF – Daily chart)

Reports that some 50% of all positions in the KRE ETF (US regional bank ETF) are positioned for downside have been widely talked up, where this figure stood at 42% last week. A speculative attack on bank equity will not sit well with Biden, the Fed, or the FDIC, as rapid declines in equity just accelerate depositor concerns and potentially push more capital into money market funds and the Fed’s RRP facility.

Some have suggested that we’re closer to a point where US authorities could look at curbs on short selling of bank equity. I’d argue the barriers here are high, where since the GFC the Fed has put out numerous white papers on the efficacies of short selling and see the function as a net positive to financial markets.

However, the move in bank equity certainly brings the focus back on instability risk, at a time when the Fed were likely going to skew its focus back on growth and inflation.

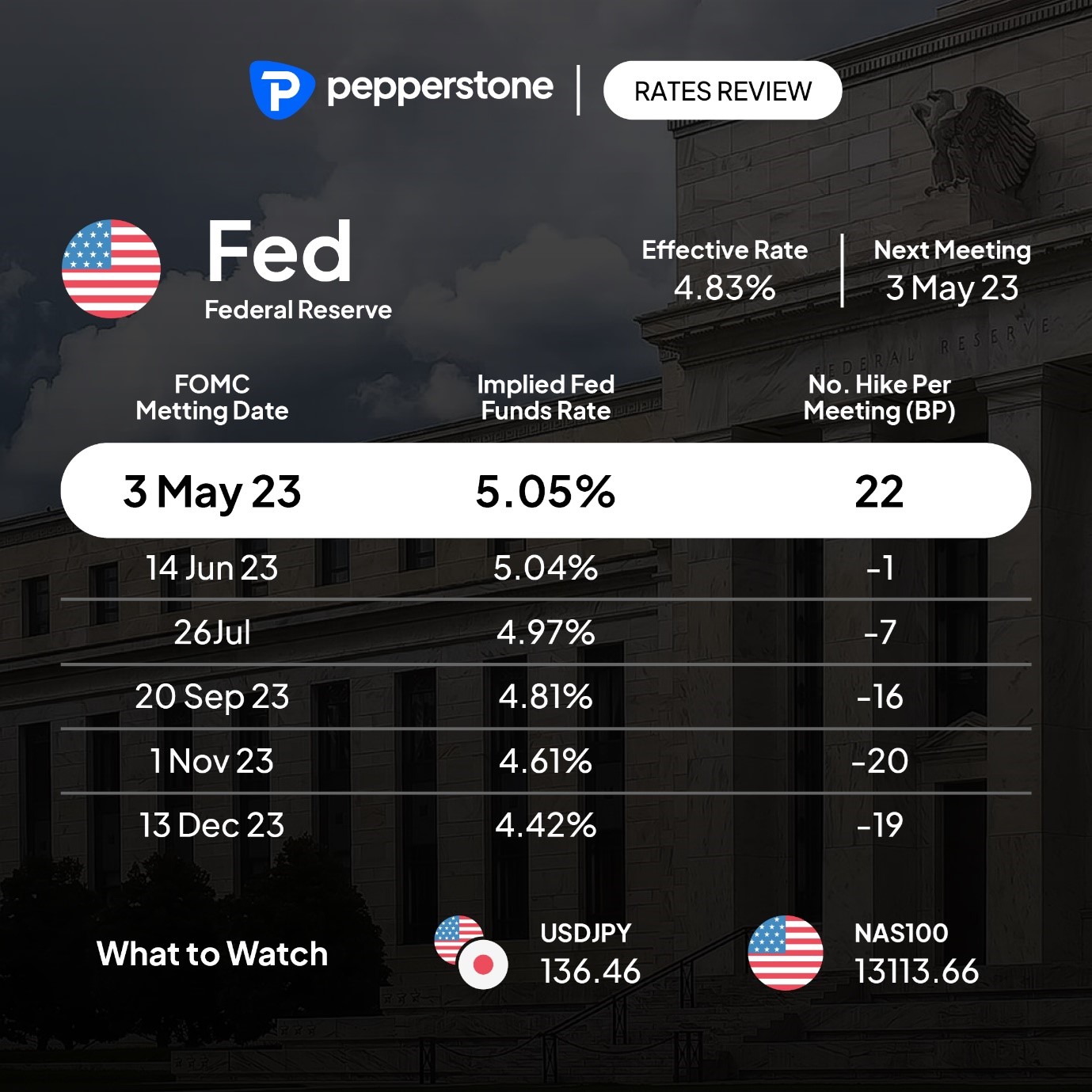

(Market pricing per Fed meeting)

We’ve seen a reaction in interest rate markets to the move in bank equity – so, while the market sees a 25bp hike in today’s FOMC meeting, we can look forward and see nothing priced for the June FOMC meeting, with cuts starting to be priced in July. Looking forward and Fed funds futures price 45bp of cut into December and SOFR futures are pricing a punchy 210bp of cuts between August 2023 and December 2024.

Market pricing almost sets us up for a rerun of yesterday’s RBA meeting, where very little is priced and should the Fed offer any sort of tightening bias in its outlook – and overlook the financial stability risk – then the skew is very much in favour of a hawkish reaction – i.e. we initially see US bond yields and the USD higher, with gold sellers in the mix.

I would assume that this initial move would be short-lived as any decent spike in US bond yields would see bank equity take another leg lower and traders will simply reapply USD and crude shorts and buy gold and JPY as a hedge. The need to be agile and nimble has never been higher.

We also know the debt ceiling is also a growing issue. There seems very little chance we get a bipartisan agreement by early June and we’re already seeing real stress play out in the US Treasury bills maturing in early June, with yields in these short-term debt markets rocketing higher. That stress is not yet seen in VIX June or July futures or FX forward implied volatility – that should change soon.

The wash up is the Fed’s statement will need to be balanced and more importantly Fed chair Jay Powell will need to absolutely nail his communication in the press conference and recognise the moves in regional bank equity as something they are closely watching - or we could see a re-run of the anxiety seen in March.

The narrative is incredibly fluid, but we’re clearly at an inflection point and things can change rapidly – an open mind to react to price action will serve you well.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.