Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

The Greenback’s Growth And Yield Advantage Should Persist

Often, trading through a ‘global macro’ lens can seem a little daunting, with a plethora of moving parts needing to be digested, and the constantly shifting global economic landscape needing to be closely monitored, for even the slightest of shifts in incoming data, news flow, or central bank rhetoric.

However, at risk of over-simplifying, and particularly in the FX arena, one can boil the theme down to two specific factors – growth, and yield. Typically, those currencies displaying the strongest growth, and highest yield, are most attractive, with the opposite being true of those displaying a more anaemic pace of expansion, and lower yield.

Examining each of these characteristics across the G10 space at present, helps provide an explanation as to the USD’s strong performance YTD, and rationale as to why said performance looks set to continue for some time to come.

Firstly, growth.

Judging from the most recent round of PMI surveys, the US continues to lead the pack in terms of its DM peers, with only the UK outpacing growth seen in the world’s largest economy, as the rebound from technical recession in the final six months of 2023 continues.

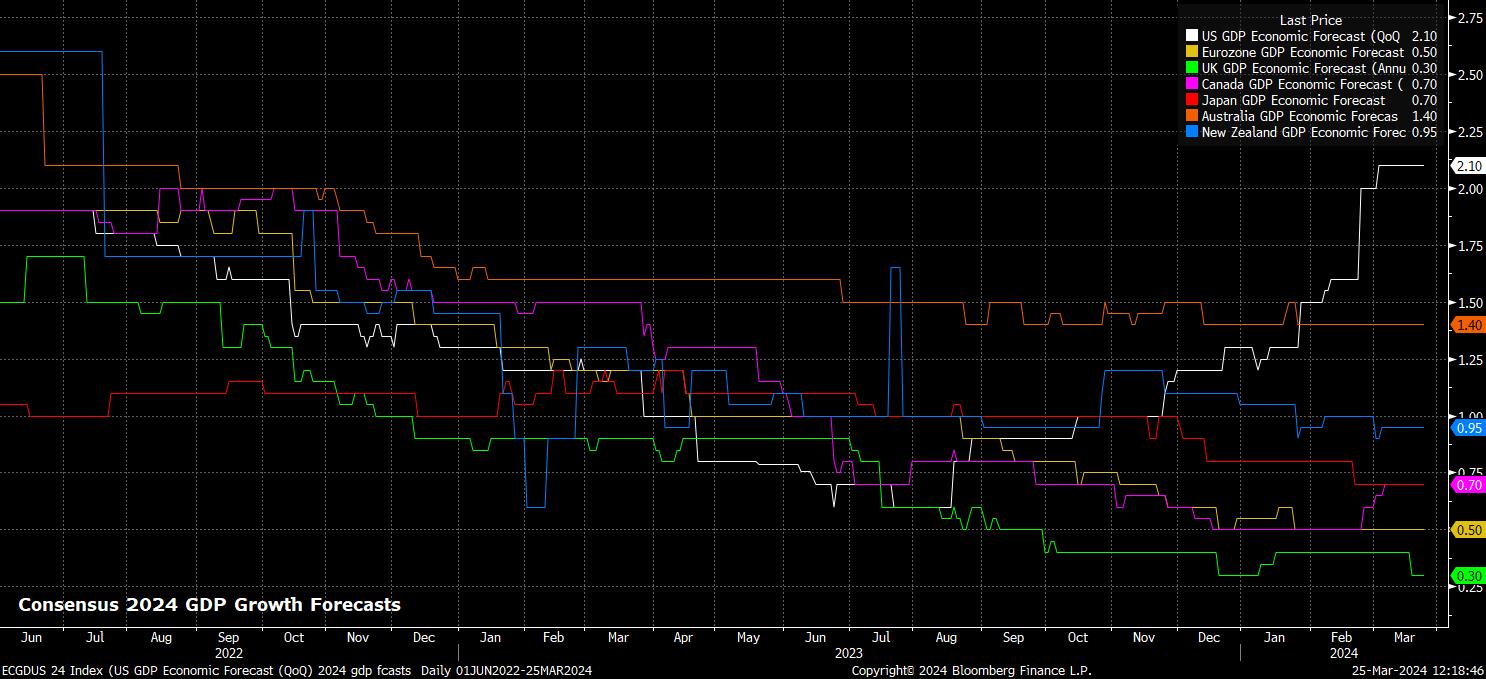

Consensus points to this economic outperformance continuing, as a quick glance at expectations for full-year GDP growth shows.

Not only is US growth set to vastly outperform that seen in other DM economies, with double the pace of growth expected in most instances, but expectations for the pace of 2024 US GDP growth have continually been ratcheted higher throughout the year, as consensus becomes increasingly pessimistic on the outlook for other major economies.

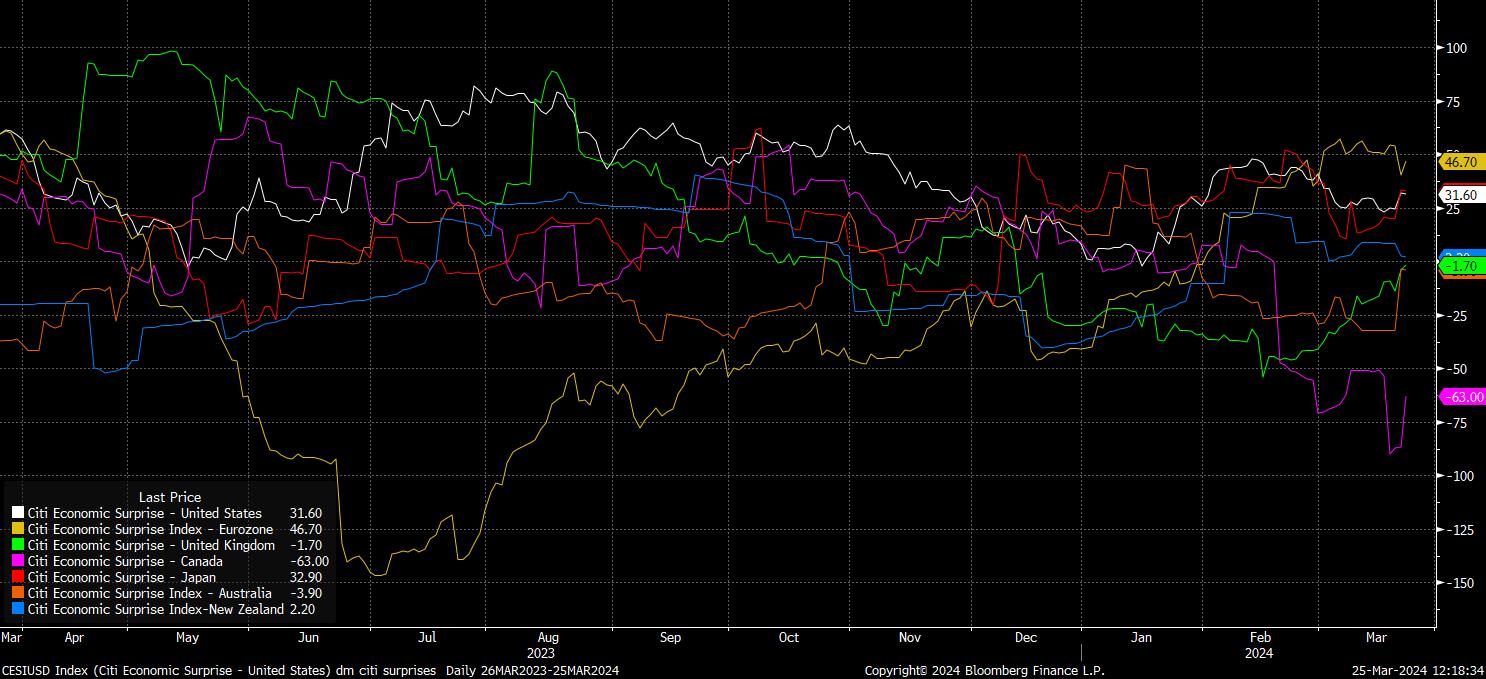

Perhaps the only blot on the buck’s copybook, from a growth perspective, comes in terms of how recent data has compared to expectations.

Citi’s economic surprise indices show how the magnitude of upside economic surprises has subsided since the beginning of February, at the same time as data has begun to surpass expectations by a more significant margin in other DM economies.

That said, by their very nature, economic surprise indices tend to mean revert over time, as expectations and forecasts are marked-to-market, hence this alone is not a convincing enough reason to pronounce the death of the dollar bull run.

After growth, comes yield.

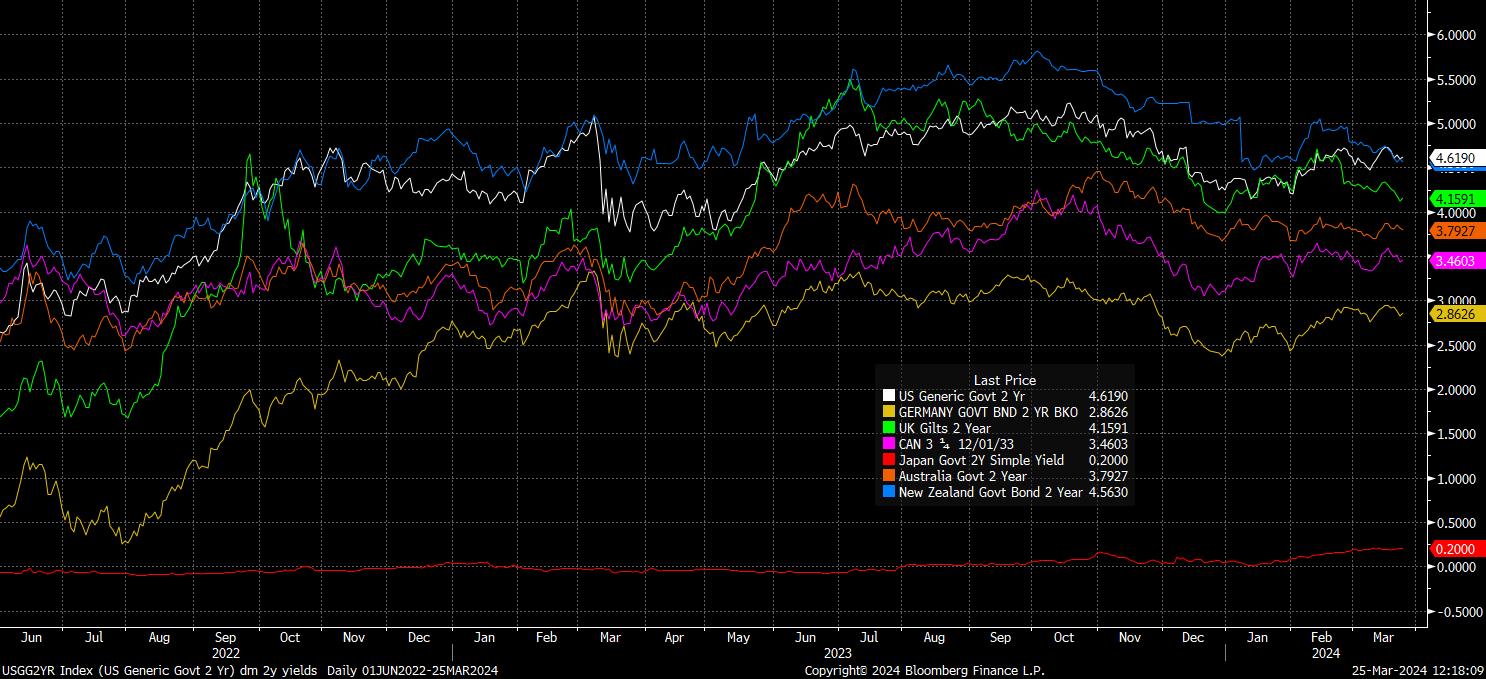

Once again, a relatively cursory glance at front-end nominal yields across the globe shows that, despite having rallied since Q3 23 as expectations of central bank rate cuts continue to grow, benchmark 2-year Treasuries continue to offer a significantly greater yield than DM peers, with US-RoW spreads actually having widened of late in the greenback’s favour.

As with growth, expectations are for this yield advantage – which, notably, is also present on a real and not only nominal basis – to continue for some time to come.

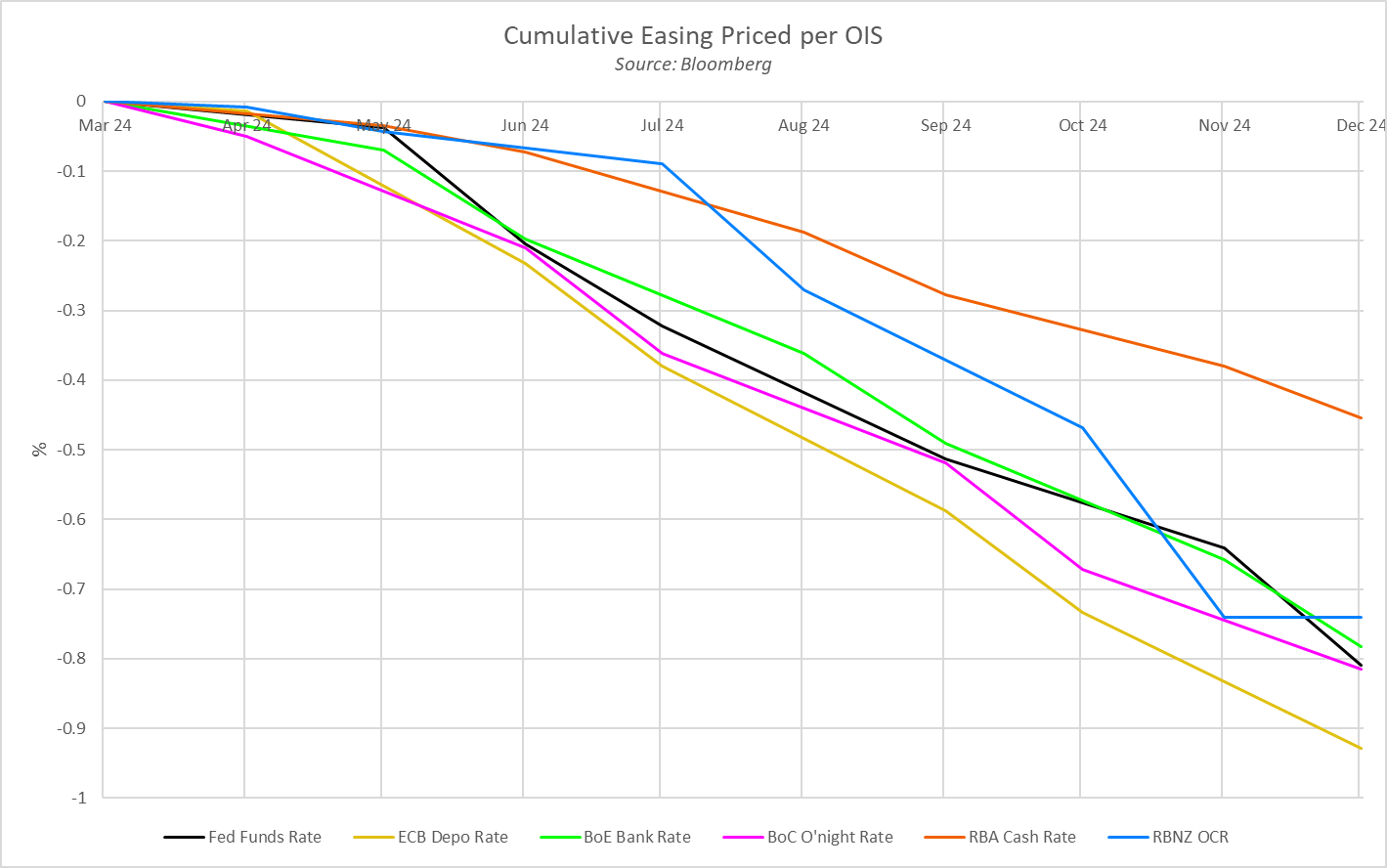

Per overnight index swaps, market expectations point to the FOMC delivering significantly less easing than most G10 peers by the end of this year, most obviously pricing a more hawkish outlook for the Fed than for the BoC, and the ECB, as market participants see approximately a 60% chance that policymakers in Frankfurt deliver four 25bp cuts this year.

Perhaps of more importance, though, particularly taking into account that the rate path implied by OIS is representative of a policy distribution covering a range of possible economic scenarios, and not a ‘set in stone’ road that rates will take, is how these expectations have shifted over time.

As has been discussed at length in these pages, market-based rate expectations have repriced sharply in a hawkish direction since the start of 2024, with OIS having shifted from pricing as many as six 25bp cuts at the start of the year, to now pricing just over three. Even the FOMC’s own expectations have become more hawkish, even if the median dot continues to imply 75bp of cuts this year, with just 1 policymaker seeing a greater amount of easing required this year, compared to five at the December FOMC, implying more significant upside rate risks.

Putting all of this together, it is relatively clear that the US exceptionalism narrative – one of stronger growth than peers, and a more hawkish policy outlook to boot – is rooted in solid fundamentals, and factors which look set to continue over both the short- and medium-term; particularly, if incoming inflation data continues to prove hotter-than-expected, the US labour market remains tight, and if the economy is able to continue its recent strong record of >2% GDP growth in each of the last six quarters running.

Subsequently, the path of least resistance for the buck should continue to lead higher, with dips likely to prove relatively shallow in nature, and be rapidly bought.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.