Playbook For The September ECB Decision

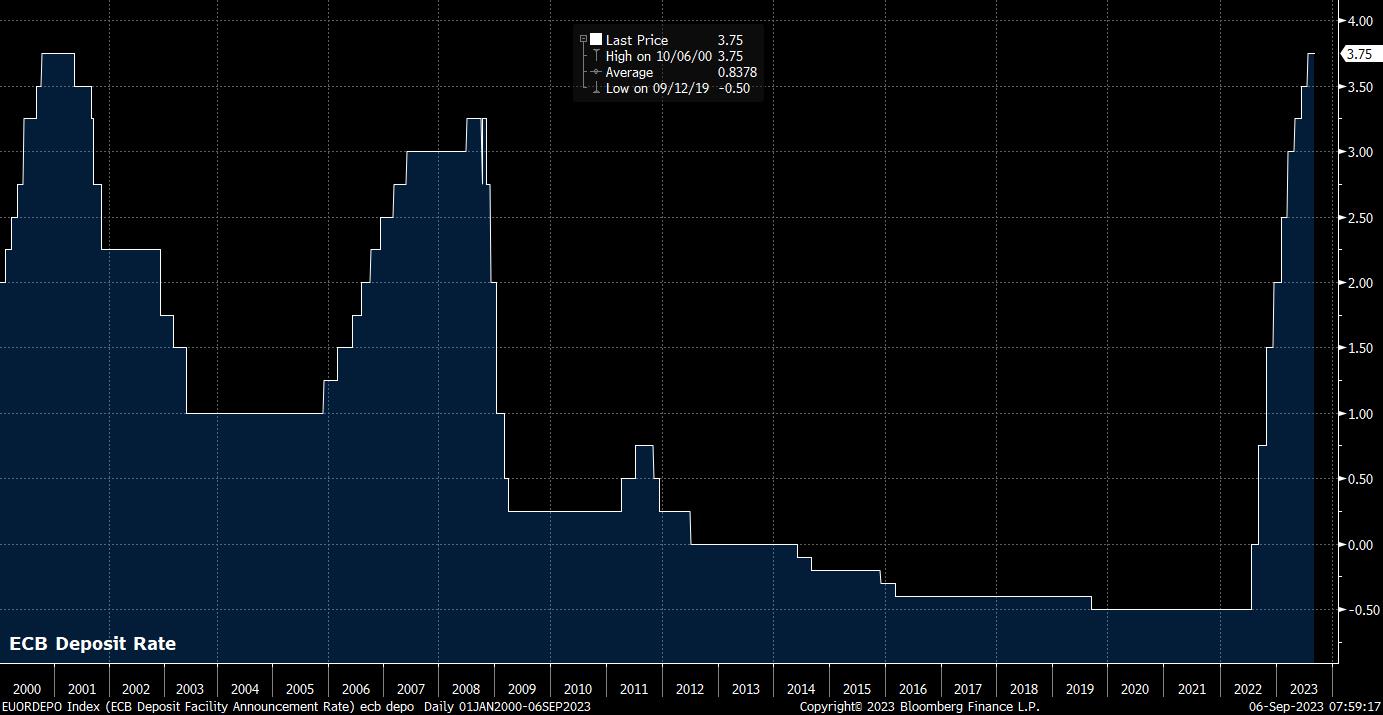

As noted, the upcoming ECB meeting is almost a coin-flip between another 25bp hike, or rates remaining unchanged, with the deposit rate currently at 3.75%, its highest level since 2001.

The balance of risks tilts marginally towards the ECB leaving rates unchanged at this meeting; a recent, albeit modest, fall in core CPI likely gives the doves a degree of bargaining power in policy deliberations, while a clear slowing in economic growth, combined with intensifying risks emanating from China, are likely to weigh heavy on policymakers’ minds. Furthermore, even typically hawkish Executive Board member Schnabel has recently taken on a more cautious tone, while other hawks Wunsch and Nagel have no vote at this meeting, as part of the regular rotation of voting Governing Council members.

On the other hand, policymakers may wish to deliver one final 25bp hike, taking the deposit rate to a record high 4%, in order to signal that the battle against high inflation is not yet over. Additionally, were the ECB not to hike in September, a ‘pause’ is likely to turn quickly into the conclusion of the tightening cycle, with a further deterioration in growth during the autumn likely slamming the door on the possibility of resuming the hiking cycle.

OIS implies exactly this, with money markets pricing just a 25% chance that the ECB hike this month, while pricing just 12bp of tightening by the October meeting, roughly implying a 50/50 probability of a move that month.

While the guidance issued by the Governing Council will, naturally, depend on the course that policy takes, a data-dependent approach is likely to still be followed, with the ECB set to continue to determine policy based on the trifecta of the inflation outlook, underlying inflation dynamics, and the strength of policy transmission across the bloc’s economy.

Any hawkish language shifts can almost certainly be ruled out given the fragile state of the economy, while any dovish nods towards the tightening cycle being over are likely to result in too significant an easing of financial conditions for the Governing Council to take such a course. Given the aforementioned fragility, changes to the gentle pace of balance sheet reduction, conducted only via the halting of reinvesting principal payments from maturing securities, is set to continue unchanged.

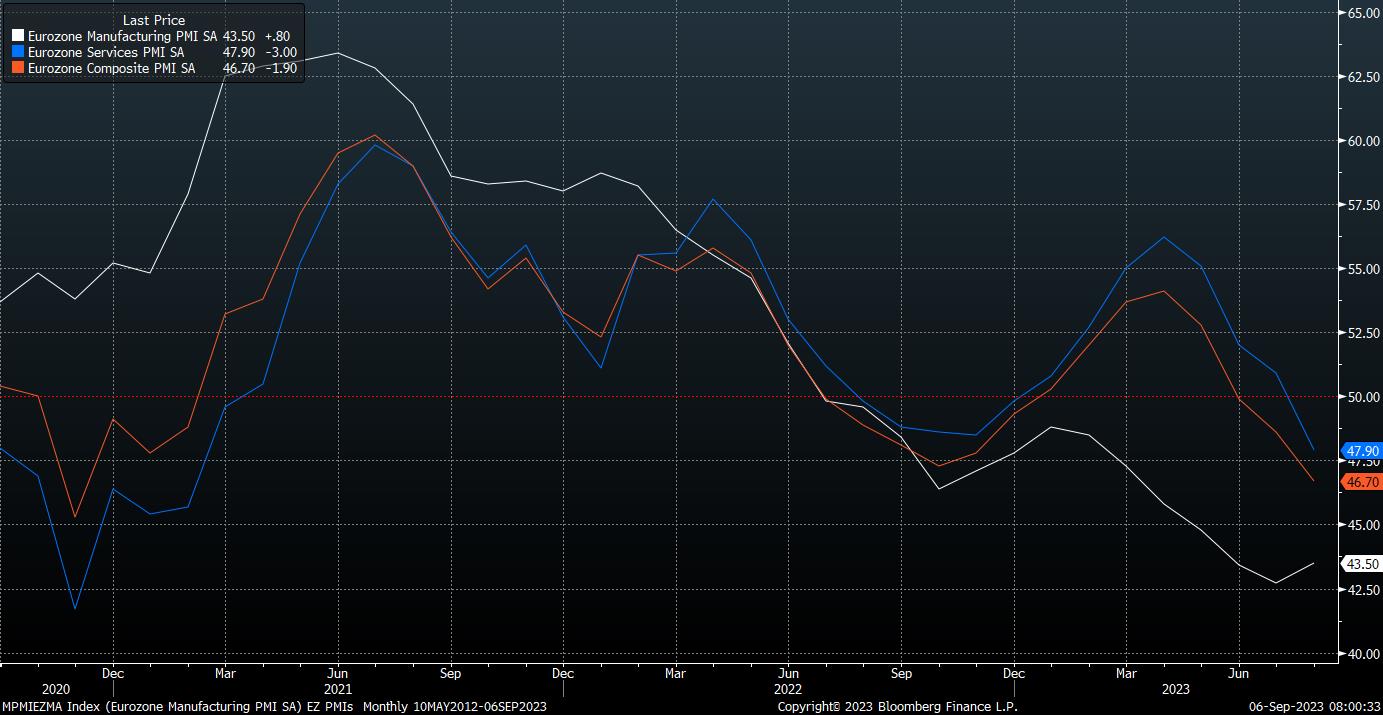

On the subject of the economy, growth has clearly and significantly weakened over the course of the summer. The latest round of PMI surveys pointed to a sharp slowdown in the month of August, with output in the manufacturing sector contracting for 14th straight month, as the services sector contracted for the first time this year. Combined, output across the bloc’s economy retreated at its fastest pace since November 2020, when the second wave of the pandemic was beginning to ravage the bloc.

This, alone, is not the only cause for concern for the ECB. Global economic risks continue to intensify, in particular those stemming from China, upon whom the eurozone depends for significant demand both in terms of industry, and the large luxury goods sector. Couple this likely future deterioration with the present severe weakness being seen across the economy, and the ECB’s forecast for 0.9% growth in 2023 is looking rather ambitious, to say the least. This, as well as the 2024 and 2025 growth forecasts, is likely to be revised a few bps lower.

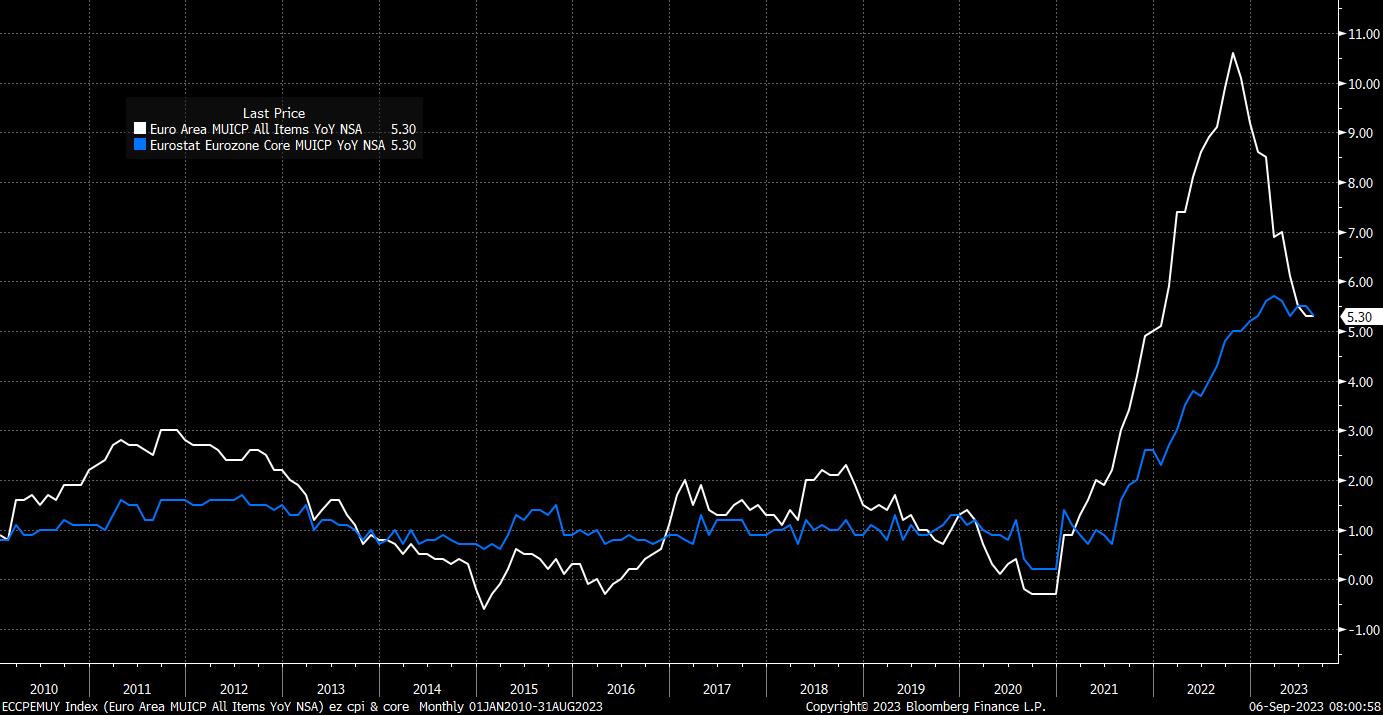

On the inflation side of proceedings, things are similarly grim for policymakers. While headline price pressures have continued to fade, with HICP falling to 5.3% YoY in July, and remaining there in August, core prices remain elevated. Sticky core inflation is likely of increasing concern to policymakers, with HICP ex- energy, food, alcohol and tobacco having printed above 5% every month since last October, and having not faded just 0.4% from the cycle high 5.7% seen in March.

In light of this, and with leading indicators pointing to there being little chance of inflation fading significantly in the short-term, the ECB’s staff macroeconomic forecasts are likely to relatively unchanged on this front, again pointing to headline HICP remaining above 2% YoY for the entirety of the forecast horizon.

Besides the latest projections, there are a couple of other areas of interest at the upcoming meeting. President Lagarde’s post-meeting press conference may provide additional guidance on the policy outlook, though any firm commitment to a pre-determined rate path is incredibly unlikely, as is any explicit reference to the degree of unanimity among Governing Council members around any decisions taken. The typical post-meeting ‘sources’ stories are likely to provide significantly more colour here, though the timing of such reports can vary, and may not break until late-afternoon.

As for the market reaction, risks to the EUR appear relatively evenly balanced; with just a 1-in-4 chance of a hike priced by money markets, such a move would likely result in a knee-jerk rally, though with any hike likely to be ‘one and done’, upside may be short-lived. Alternatively, any pause in the tightening cycle is likely to be immediately interpreted as the conclusion of said cycle, further enticing EUR bears.

_eurusd_mb_2023-09-06_08-02-04.jpg)

From a technical perspective, with longstanding support at 1.0750 having given way, in addition to the EUR having closed beneath the 200-day moving average on back-to-back days, the bears have the upper hand at present, with immediate support next coming at 1.0650, before attention will likely rapidly turn to the 1.0500 figure. To the upside, rally sellers should thrive unless price breaks back above 1.0820 (the 200-dma), above which the 100-, then 50-day moving averages mark near-term resistance.

Meanwhile, for European equities, the longer-run outlook continues to hinge primarily on developments in China, the source of the majority of demand, rather than the ECB policy outlook.

Nevertheless, the DAX testing support at 17,500 is of interest, particularly with a closing break leaving the door open for recent losses to continue towards the 200-day moving average, and the psychologically key, 15,500 mark.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。。。