Macro Trader: The Smile Continues To Work For The Dollar

The greenback has continued to gain ground of late, with the USD rallying to fresh YTD highs against a basket of peers - per both the dollar index (DXY), and Bloomberg’s broader measure (BBDXY).

_2024-04-16_09-05-10.jpg)

The move comes amid the persistence of the US exceptionalism narrative that has driven the G10 FX market for much of the year, as well as the emergence of another traditionally USD supportive factor; namely, rising geopolitical risk, and a subsequent surge in demand for safe havens as participants seek shelter.

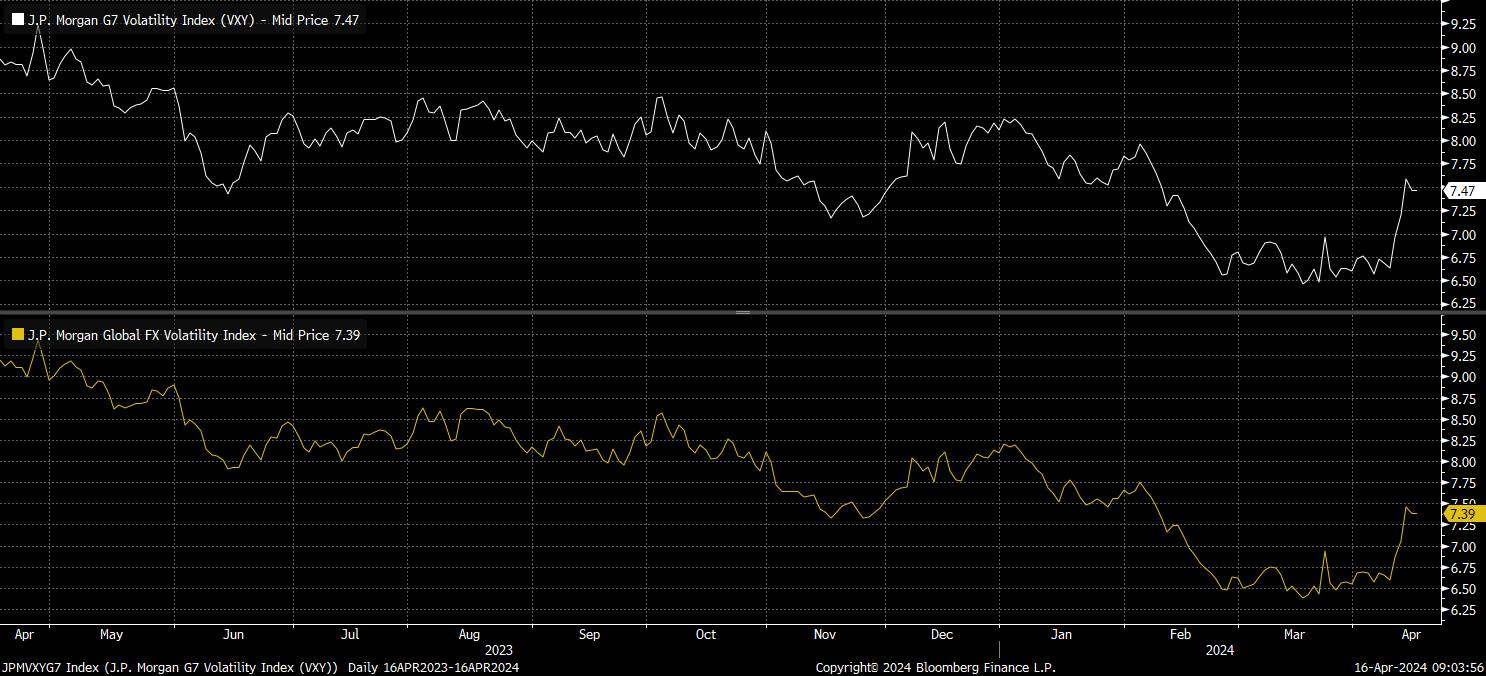

Unsurprisingly, this rise in risk as Middle East tensions appear to escalate, after Iran’s weekend attack on Israel, and as markets brace for potential retaliation, has seen volatility rise across the board. In the FX space, in particular, JPMorgan’s gauge of FX implied volatility, on both a global and a G7 basis, has risen to its highest since early-February.

Perhaps the easiest way to visualise the factors behind USD’s recent strong performance is to return to a familiar concept - the so-called ‘dollar smile’.

This theorises that the dollar tends to appreciate in two environments; when global risk aversion takes hold; or, when the US economy outperforms peers, and the dollar subsequently benefits from a yield advantage.

On the former, risk appetite is clearly on relatively shaky ground at present. Gold continues to print fresh record highs in an almost daily basis, apparently standing as the portfolio hedge du jour for most participants.

Meanwhile, stocks have slipped over recent weeks, with the S&P closing on Monday below its 50-day MA for the first time since last November, while also notching a 2-day drop of over 2.6%, the most in over a year. I would argue, however, that with economic growth still strong, earnings resilient, and the central bank ‘put’ still alive & well, the path of least resistance over the medium-term should continue to lead higher.

Meanwhile, on the matter of US outperformance, it is clear that the economy is diverging significantly from DM peers.

This is particularly true of economic growth, with GDP growth having exceeded 2% on an annualised quarterly basis for the past six quarters in a row, as momentum remains anaemic elsewhere, particularly in Europe where risks also remain tilted to the downside.

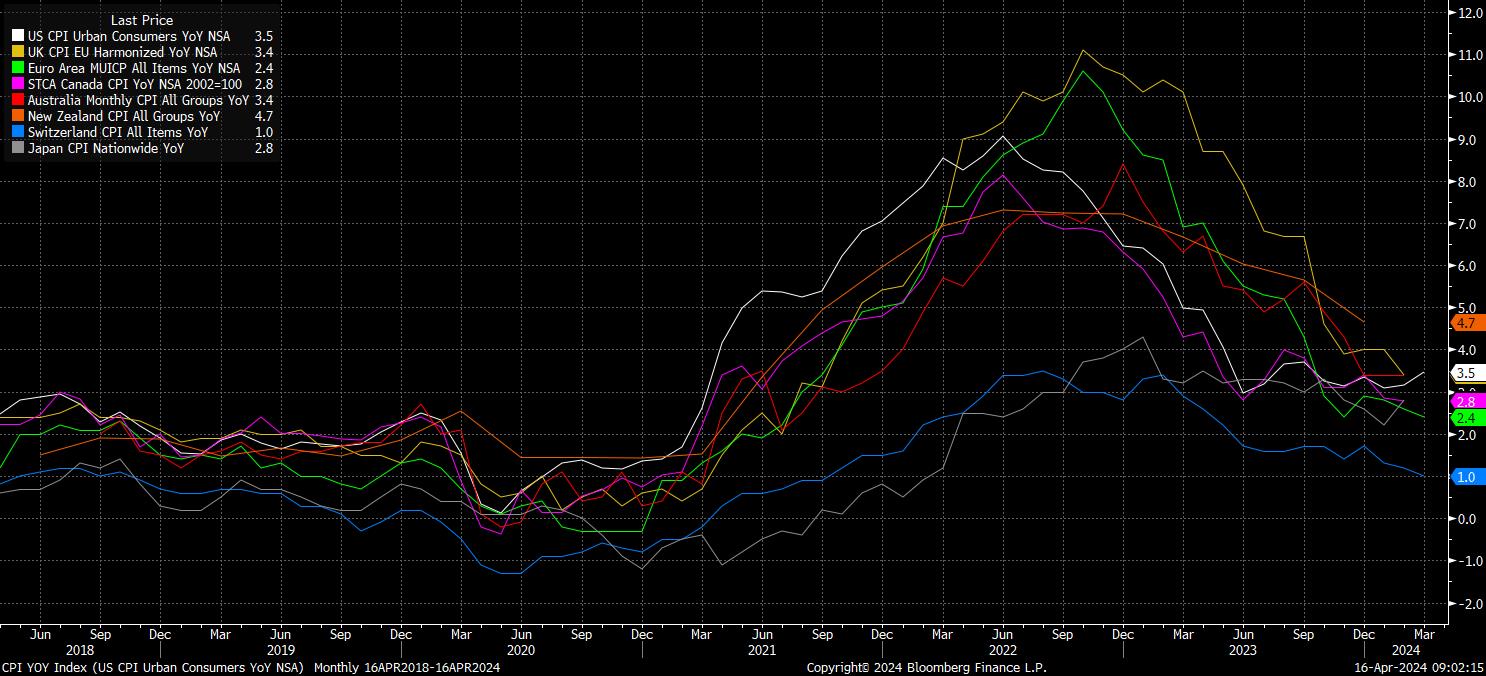

It is also the case when one examines the inflation outlook. Last week’s CPI report reiterated the stubborn and sticky nature of price pressures within the US economy, with headline prices rising by an unexpectedly strong 3.5% YoY, in an energy-driven re-acceleration from a month prior, while core CPI remained unchanged at 3.8% YoY. This is in sharp contrast to inflation developments elsewhere, with disinflationary progress towards central banks’ 2% targets proving substantially quicker than had been expected.

In turn, this is helping to tilt the balance of risks for the Fed outlook, and that of other G10 central banks, in opposite directions.

If one were to look simply at incoming Stateside data, one would probably question the need for cuts at all, with growth resilient, inflation sticky, and the labour market incredibly tight. In many ways, the primary reason why rate cuts are being discussed, is simply because Powell & Co. have told us that they plan to cut as the year progresses.

Naturally, markets have hawkishly repriced the Fed outlook of late, now pencilling in the first cut for September, and less than 50bp of easing this year - around a third of what was priced at the turn of the year!

On the other hand, data elsewhere suggests that cuts are coming much sooner, and likely to a much greater degree.

The SNB, for instance, have already kicked off their own easing cycle, having delivered a 25bp cut in March, with Swiss inflation having reached the bottom of the target band. Meanwhile, the Riksbank look set to cut at the next meeting in May, and the ECB have all-but-confirmed that the first cut will come in June.

The BoE also seem likely to deliver the first cut of the cycle early in the summer, with joblessness in the UK now standing at a 6-month high, and inflation set to kiss the 2% target during the spring. While the antipodean central banks - the RBA & RBNZ - are likely to wait until August to follow suit, risks here are also skewed in a dovish direction.

Hence, while recent geopolitical developments may have given the greenback a further leg higher, dollar demand should persist even once the recent strife begins to fade from the minds of market participants, with the greenback’s yield advantage, and favourable FOMC policy divergence, set to provide continued support.

Certainly, this is the message that derivatives are currently sending. 3-month, 25-delta risk reversals, in both EUR/USD and GBP/USD, both trade to their most negative since November 2023, implying puts trading at the greatest premium to calls since that time, and thus the most bullish USD sentiment since late last year.

In summary, then, while the USD has already gained around 5% against a basket of peers this year, and trades in the green against all G10 peers, this strong upside momentum looks set to have considerably more room to run.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。