Both FTSE100 futures and FTSE100 CFDs allow you to get exposure to the 100 largest companies listed on the London Stock Exchange. There are some key differences between FTSE futures and a contract for difference. Let’s look deeper.

FTSE futures and how they are traded

A futures contract is an agreement between two parties to buy or sell a product or asset at a predefined price and date.

Popular futures contracts are based on Foreign Exchange, Commodities, Indices and Stocks. Futures contracts are traded on a futures exchange such as the Chicago Mercantile Exchange (CME) or, in the case on FTSE futures, the LSE and the Intercontinental Exchange (ICE).

Contracts, Codes and Expiration Dates

Although futures contracts are often offered with a monthly expiry, depending on the product, the most popular contacts are quarterly with the expiry being the third Friday of the third month. This is known as Triple Witching.

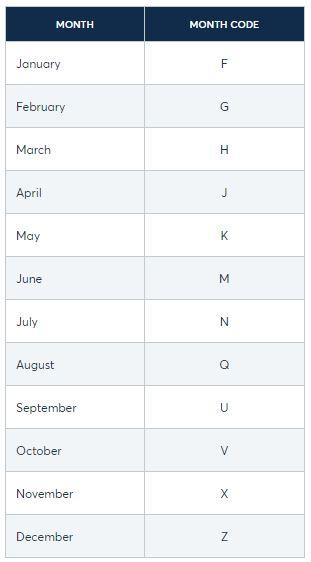

Each product and each month are defined by a unique code.

The FTSE100 December 2022 code is: XZ22.

X is the FTSE100 symbol. Z is the contract date. 22 being the year.

Figure 1 CME Group

Futures are traded in contracts. One FTSE futures contract has the value of £10 per point.

A CFD, contract for difference

Acontract for difference is a contract between a buyer and a seller that stipulates that the buyer must pay the seller the difference between the closing value of an asset and its value at the opening of the trade.

The main differences between FTSE futures and CFDs

The main differences between trading a futures contract and a CFD are:

- Futures market participants tend to be banks and large financial institutions

- Futures contracts have larger spreads but do not require overnight funding. This can make them the preferred choice for long-term speculation

- CFDs do not have expiration dates

- Trading futures can require larger margins or deposits

- Although there is the possibility of trading micro futures contracts, CFDs are generally more flexible when it comes to trade size

- CFDs are over-the- counter products (OTC). They are traded through network of brokers and not through an exchange

How to trade the FTSE with Pepperstone

You can get exposure to FTSE100 CFDs through Pepperstone. To get more information please click here.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。