分析

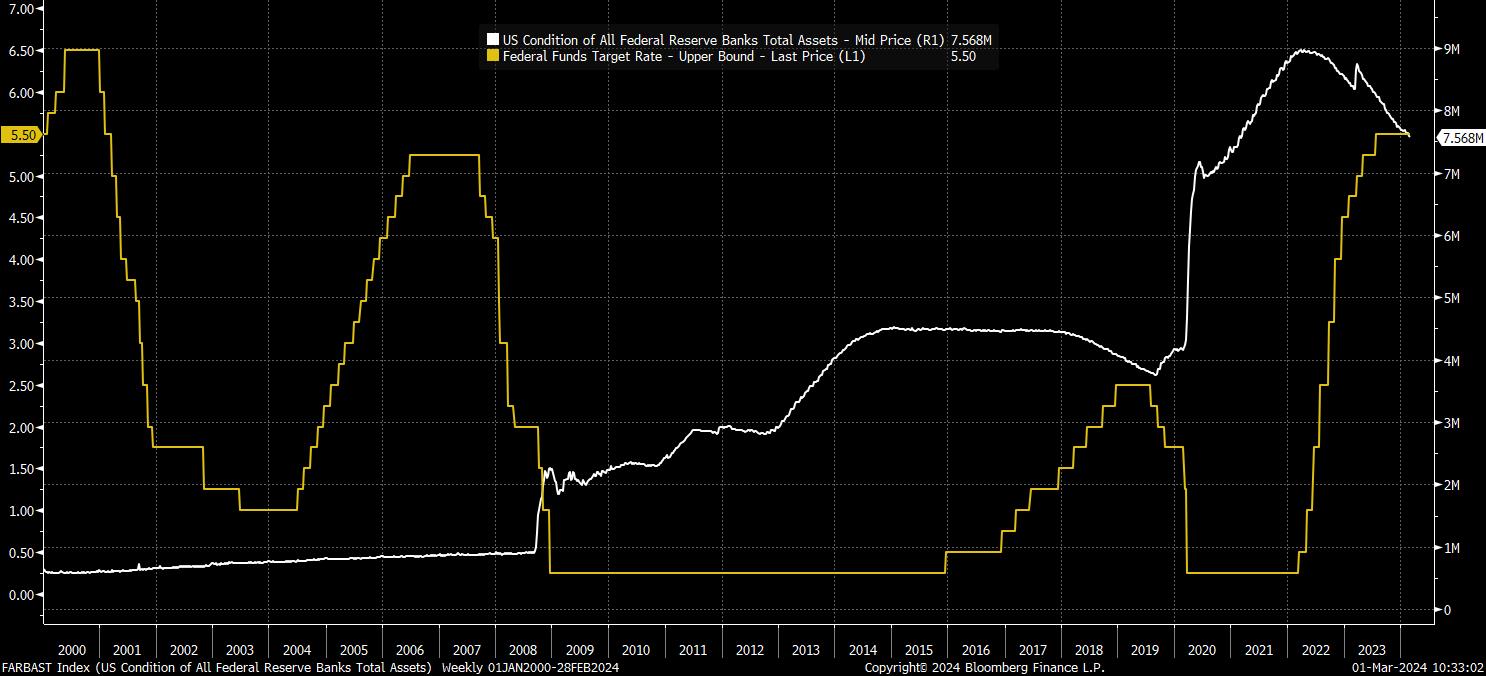

In order to contextualise this new regime, it’s worth framing the policy picture more broadly, using the two main tools in the central bank toolkit – overnight interest rates, and the balance sheet. At a basic, and perhaps over-simplified level, we have had three regimes since the turn of the millennium:

- Pre-GFC existed a regime where rates were set somewhere near 5%, well into restrictive territory, while the balance sheet and asset purchases were not used as a policy tool in the way with which we are now familiar

- Post-GFC, and immediately post-pandemic, the regime shifted to one where rates were pinned at, or as near as makes no difference at, the zero lower bound, with seemingly infinite QE, and ever-expanding balance sheets, doing most of the heavy lifting in terms of policy stimulus

- And, now, in the post-covid world where disinflation continues, we look set to shift to a regime where rates move back to a more neutral level (probably around 3% on a nominal basis), and central bank balance sheets remain at incredibly lofty levels, well above where they sat pre-covid

Naturally, this second regime change begs the question as to what its consequences are likely to be.

In many ways, at least in the short term, such an environment could prove to be the ‘best of all worlds’ for riskier assets. Naturally, a less restrictive policy stance should provide a fillip to equities, while also loosening financial conditions more broadly, thus providing further support to the idea of a ‘soft landing’. Furthermore, one must remember that said rate cuts will come with the Fed’s balance sheet settling at a level considerably above $7tln once quantitative tightening comes to an end – 7x bigger than pre-GFC.

That’s an extra $7 trillion of liquidity that will now remain, likely permanently, in the financial system, providing a further backstop to the equity market. In turn, this should keep levels of equity vol relatively low, with a sub-15 VIX perhaps becoming the ‘new normal’. Furthermore, perhaps traditional valuation metrics matter less than they have in the past, given how starkly different the monetary regime now is.

On that note, that obviously also represents around $7tln of US government debt that will, in perpetuity, remain on the Fed’s balance sheet. Effectively, monetising that chunk of debt, and likely allaying some still-lingering concerns about the rate of government borrowing.

While equity vol will likely remain low, rates vol is likely to move higher, particularly in the early stages of the easing cycle, as front-end rates continue to adjust expectations as to when the first rate cut will be delivered.

In the grand scheme of things, however, when that cut is delivered – whether it comes in May, June (my base case), July, or later – matters relatively little. The broader direction of travel will be a move back towards neutral, likely through a 12-18 month long easing cycle from the summer onwards.

There is also, of course, the not-so-insignificant matter of the flexible Fed put that is now well and truly back. While consensus very much favours the Fed cutting rates, and ceasing QT, this year, both in relatively orderly fashion, the successful return of inflation towards the 2% target has provided policymakers with significant optionality and flexibility as to how they conduct policy going forward. If a financial accident were to occur, rates could be cut more rapidly, and to a lower level, while targeted liquidity injections into any potentially troubled sectors of the economy would also likely be on the cards.

Being safe in the knowledge that, once more, the Fed have investors back, market participants will likely be able to continue substantially increasing risk exposure, particularly once the first cut has actually been delivered.