Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Bernie Sanders in front for Democratic nomination. What does this mean for markets?

It’s a development that will spook markets and cause a panicked flee to safe havens if a Sanders vs Trump election looks increasingly likely.

The Vermont Senator was trailing behind former Vice President Joe Biden in polls across the board the last few weeks, but has landed a considerable lead just one week out from the 3 February Iowa caucuses.

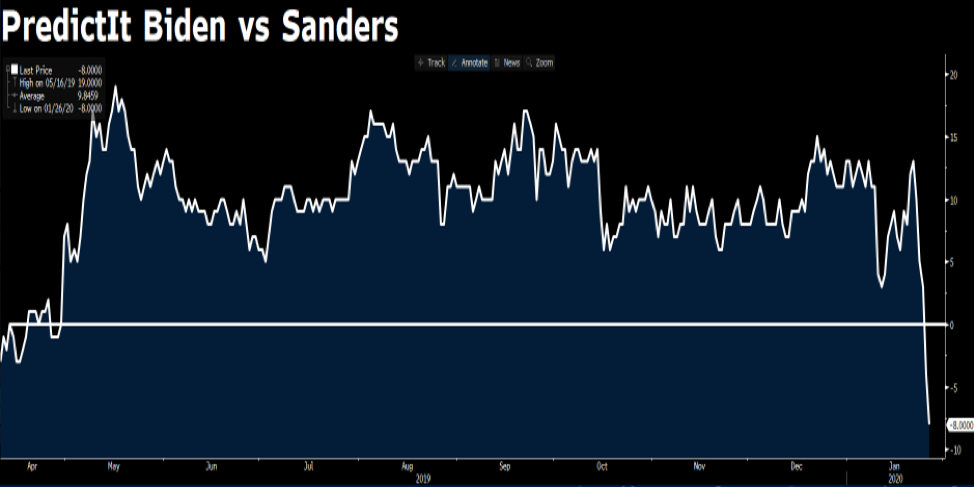

PredictIt\u2019s poll spread between Biden and Sanders has had Biden considerably ahead for months. Sanders has taken a quick, clear lead.

A New York Times / Sienna College poll finds Sanders ahead of the pack in Iowa, with 25% of likely caucusgoers selecting him as their first choice. Buttigieg comes next at 18%; Biden 17%; and Warren 15%.

His surge in popularity has seemingly come at the expense of his fellow progressive candidate Elizabeth Warren. In Iowa, she has dropped just below 15% support. Even in her home state Massachusetts, where she had been polling ahead, Sanders and Biden now share an equal lead in polls.

A win for Bernie Sanders in Iowa is not unreasonable. He’s an established name there, sweeping 49.6% of the vote in the 2016 caucuses, losing by only 0.3 of a percentage point to Hillary Clinton’s 49.9% victory. Plus, favourability polls show Sanders’ followers are the most loyal and least likely to change their minds.

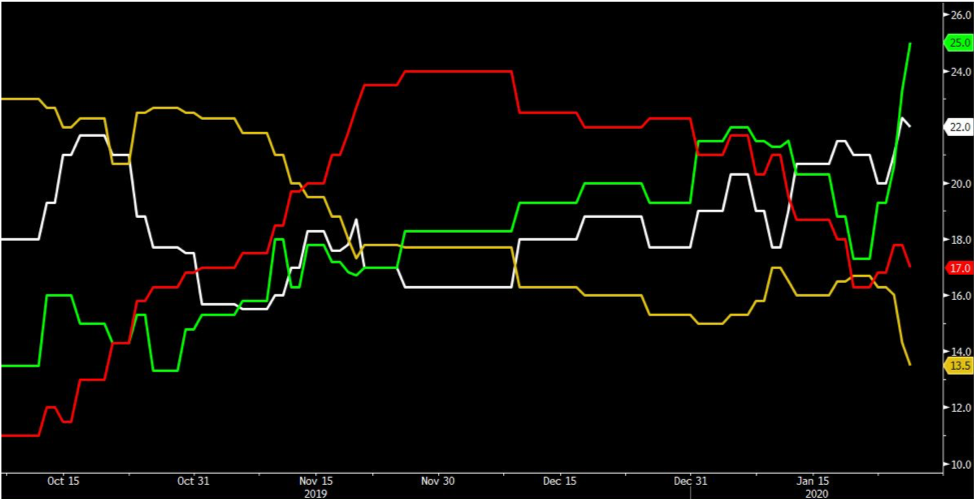

Similarly, Real Clear Politics has Sanders (green) pushing ahead in Iowa to 25%, surpassing Biden (white) at 22%, Buttigieg (red) at 17%, and Warren (yellow) at 13.5%.

Source: Bloomberg, Real Clear Politics

Of course, due to the peculiarities of the Iowa caucuses, you must consider second choice votes for those whose candidates fail to clear the 15% threshold and are eliminated. Moderate liberal Amy Klobuchar sits in fifth for favorability at 8%, and polls have found 55% of Klobuchar’s supporters would move their vote to Joe Biden should she fail to meet hurdle requirements.

The Real Clear averages poll shows Warren slipping below the crucial 15% threshold. If she were to be out of the race in Iowa, one would assume a lot of her votes could shift to Sanders, due to similarities in their further-left campaigns.

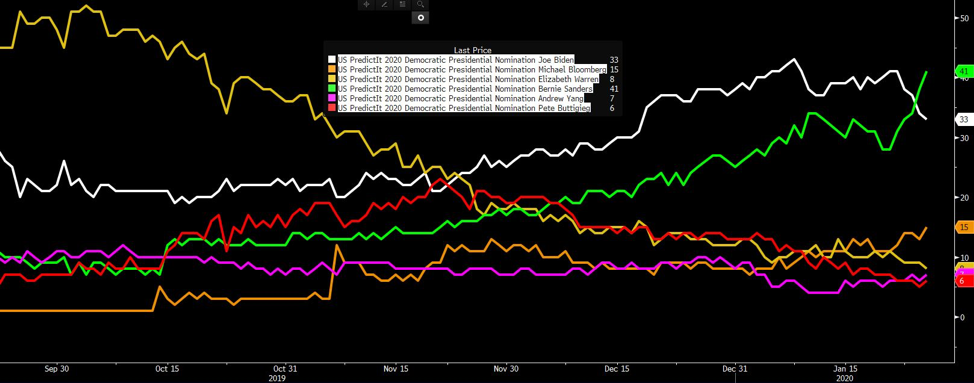

So should Sanders take out Iowa, then prevail as expected in New Hampshire, Nevada, and California, his popularity could snowball and it’ll be hard to slow the frenzy. In fact, the latest data from PredictIt sees Sanders ahead of the pack for democratic nomination for the first time. Sanders has surged to 41%. Biden has dropped to 33%.

Source: Bloomberg, Real Clear Politics. Sanders (green) ahead on 41%, Biden (white) 33%, Bloomberg (orange) 15%, Warren (yellow) 8%, Yang (pink) 7%, and Buttigieg (red) 6%.

With just one week to Iowa, his popularity couldn’t be surging at a better time.

Watch for the CNN/Des Moines Register final Iowa poll this Saturday, two days before caucuses. This will set the tone for Monday.

Markets won’t like Sanders

Bernie Sanders is a radical shift left for the Democratic party. His campaign is built on an anti Wall Street message: taking on the top end of town with sweeping financial taxes. Taxes include an extreme wealth tax, financial transactions tax, and a plan to break up the ‘monopolistic’ big tech companies.

First of all, markets like continuity, particularly when things are working. At a time when US equities are posting regular record highs, a change in administration in any form would be disruptive. Were Biden to be leading the change though, markets would know what to expect from the moderate liberal who wants to continue the work of the Obama administration.

Bernie Sanders on the other hand offers a whole new game. Financial reforms and breaking up big tech, which pull more than their fair share of US stock market gains, are a huge risk for markets and investors would begin to price accordingly.

Beyond financial taxes, a Sanders administration (or Warren as well for that matter), could be an even harder ticket than Trump for resolving the US-China trade dispute. Intellectual property rights won’t be the only major sticking point in trade negotiations. We’d expect Sanders to bring climate change and human rights issues into any possible deal, prolonging a deal and increasing uncertainty in forex markets.

Emboldened by Trump tearing up the rules on trade, Sanders would likely outdo the president’s own America-first trade policy. He’s accused the administration of failing to bring manufacturing jobs back to America as promised and has advocated for stronger job protection.

Last year’s trade tensions saw gold (XAUUSD) surge on several occasions, and yield curve inversion in August. Imagine the market panic around a harder line on trade.

If Sanders newfound lead holds and he proceeds to Democratic nomination, markets will begin to price this risk. US equities would probably feel the first blow, but gold and safe haven forex pairs like USDJPY would also see significant bids up. The strong US dollar could also fall across the board.

Stay on top of event risk, market moves, and other crucial developments with Pepperstone’s election coverage and analysis, subscribe to the Daily Fix.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.